ABOUT SSNs/TINs ON GOVERNMENT FORMS

AND TAX CORRESPONDENCE

Forms #04.104/07.004

1. Introduction

It is VERY important that we fully understand why and how the government uses numbers to identify us both on forms and in their computer systems, why it does this, and all the effects upon our rights. In fact, if you want to discontinue voluntary participation in the federal and state income tax systems, the absolute most important thing you can do is to eliminate all identifying numbers in connection with you. Understanding this can literally mean the difference between being a free person and a government slave. If you like this article, a PDF version of it suitable for use as a Memorandum of Law to attach to court pleadings is also available below:

About SSNs/TINs on Government Forms and Correspondence, Form #05.012

DIRECT LINK: http://sedm.org/Forms/05-MemLaw/AboutSSNsAndTINs.pdf

FORMS PAGE: http://sedm.org/Forms/FormIndex.htm

2. What We SPECIFICALLY Object to about Social Security Numbers and Taxpayer Identification Numbers

In our form Why You Aren’t Eligible for Social Security, Form #06.001, we prove that it is ILLEGAL for the Average American to participate in Social Security or any OTHER federal “benefit” program. Some people have claimed incorrectly that by stating this, we are undermining their ability to conduct commerce using private banking or loans. This has never been our intention and we will prove in this section why this is so.

We don’t object to holding people responsible for satisfying their contracts or agreements created in the absence of duress of any kind. Personal responsibility is, after all, the foundation of freedom and sovereignty as we admit on the opening page of our website:

People of all races, genders, political beliefs, sexual orientations, and nearly all religions are welcome here. All are treated equally under REAL “law”. The only way to remain truly free and equal under the civil law is to avoid seeking government civil services, benefits, property, special or civil status, exemptions, privileges, or special treatment. All such pursuits of government services or property require individual and lawful consent to a franchise and the surrender of inalienable constitutional rights AND EQUALITY in the process, and should therefore be AVOIDED. The rights and equality given up are the “cost” of procuring the “benefit” or property from the government, in fact. Nothing in life is truly “free”. Anyone who claims that such “benefits” or property should be free and cost them nothing is a thief who wants to use the government as a means to STEAL on his or her behalf. All just rights spring from responsibilities/obligations under the laws of a higher power. If that higher power is God, you can be truly and objectively free. If it is government, you are guaranteed to be a slave because they can lawfully set the cost of their property as high as they want as a Merchant under the U.C.C. If you want it really bad from people with a monopoly, then you will get it REALLY bad. Bend over. There are NO constitutional limits on the price government can charge for their monopoly services or property. Those who want no responsibilities can have no real/PRIVATE rights, but only privileges dispensed to wards of the state which are disguised to LOOK like unalienable rights. Obligations and rights are two sides of the same coin, just like self-ownership and personal responsibility. For the biblical version of this paragraph, read 1 Sam. 8:10-22. For the reason God answered Samuel by telling him to allow the people to have a king, read Deut. 28:43-51, which is God’s curse upon those who allow a king above them. Click Here for a detailed description of the legal, moral, and spiritual consequences of violating this paragraph.

[SEDM Website Opening Page; https://sedm.org/]

In many cases, globally unique identifying numbers are useful for enforcing PRIVATE contracts and agreements, such as bank loans. They are popular throughout the world primarily for banking purposes, in fact.

The reader might then reasonably ask:

“Well then, if you don’t object to people being personally responsible for honoring their contracts and commitments, then what is wrong with using government-issued identifying numbers that would hold people financially responsible honoring such commitments to governments?”

Below is our general answer to this question which appears on one of our forms relating to the compelled use of such identifying numbers:

This form is intended to provide succinct, convenient evidence proving beyond all doubt that the submitter may not lawfully have or use government issued STATUTORY identifying numbers and would be violating criminal and civil laws to do so. It is intended to be submitted to financial institutions, employers, and businesses who demand PUBLIC numbers from those they do business with.

For the purpose of this document, an identifying number can be either PUBLIC or PRIVATE, but never BOTH. By PUBLIC, we mean the CIVIL STATUTORY context that regulates only GOVERNMENT activities. By PRIVATE we mean the NON-STATUTORY context in which it cannot be used to enforce any civil statutory obligation owed to any government or agent of government. By “government” or “agent of government” we mean for the purposes of this document anyone acting under the alleged authority of the civil statute, such as a STATUTORY “person”, “taxpayer”, “U.S. person”, “citizen”, “resident”, “employer”, “withholding agent”, “foreign person”, etc. We don’t object to the EXCLUSIVELY PRIVATE use of identifying numbers to enforce contractual obligations anyone agreed to. We only object to the use by government or its agents to enforce civil statutory obligations against itself or its agents or officers for the purposes of raising revenue from unwilling parties. This is because Christians are forbidden from the Bible to interact with any government in any capacity other than as a Private Merchant under U.C.C. §2.104(1) and never as a Buyer under U.C.C. §2.103(1)(a) of any government civil service or public officer in the context of ordinary government functions. This is a First Amendment, constitutional right of association and freedom from compelled association protected by the Religious Freedom Restoration Act (RFRA), 42 U.S.C. Chapter 21B. See: Delegation of Authority Order from God to Christians, Form #13.007; https://sedm.org/Forms/13-SelfFamilyChurchGovnce/DelOfAuthority.pdf. A government created to protect PRIVATE property and PRIVATE UNALIENALBE rights per the Declaration of Independence must never be permitted to make a profitable business out of ALIENATING, TAXING, or REGULATING those rights. If this limit is transcended, it becomes a DE FACTO government and an ANTI-GOVERNMENT as documented in De Facto Government Scam, Form #05.043; https://sedm.org/Forms/05-MemLaw/DeFactoGov.pdf.

Therefore, so long as any identifying numbers provided are never used for any type of government reporting, withholding, civil or administrative enforcement, liens, or levies placed by any government through the Recipient as their agent, then we have no objection to their use. Any use in this for this purpose by the Recipient of this form or its agents or assigns therefore makes them the liable party for all such enforced obligations rather than the Submitter. After all, all those subjected to duress are acting as a compelled agent of the SOURCE of said duress from a legal perspective. Any civil enforcement against the Submitter is an act of duress against a nonresident party not purposefully or intentionally or consensually contracting with or doing business with any government as a Buyer.

[Why It is Illegal for Me to Request or Use a Taxpayer Identification Number (TIN) and Counteroffer, Form #04.205; https://sedm.org/Forms/FormIndex.htm]

The reader will note that ALL of our objections about the use of PUBLIC or GOVERNMENT issued identifying numbers could easily be remedied by:

- Creating a PRIVATE company or association to issue globally unique identifying numbers.

- Making these private identifying numbers NOT ACCESSIBLE by any government.

- Using the identifying numbers ONLY in connection with PRIVATE activities relating to banking and credit or PRIVATE employment verification.

- Not using the PRIVATE numbers in connection with government identification such as driver's licenses or passports.

- Not using the PRIVATE numbers in connection with any CIVIL or governmental enforcement activity, and especially in connection with penalties or income taxation.

- Enforcing the same rules of compelling contractual performance in the case of government as private companies have to follow. Namely:

- No administrative enforcement is permitted, such as penalties, liens, or levies.

- Enforcement requires a common law court action in equity to enforce the contract.

- The contract must meet all the requisite elements of a real PRIVATE contract, such as an offer, mutual consideration, mutual obligation, mutual consent, the absence of duress, etc.

- Sovereign, official, or judicial immunity may not be asserted by either party to escape the obligations of the contract.

Government “benefits”, civil statutes, and the civil statutory franchises which implement them would not, do not, and never have been enforceable by the same standards of proof for private contracts indicated above. Below is the reason why we object to them which appear in our website Disclaimer:

SEDM Disclaimer

Section 4.10. FranchiseThe injustice (Form #05.050), sophistry, and deception (Form #05.014) underlying their welfare state system is that:

- Governments don't produce anything, but merely transfer wealth between otherwise private people (see Separation Between Public and Private, Form #12.025).

- The money they are paying you can never be more than what you paid them, and if it is, then they are abusing their taxing powers!

To lay, with one hand, the power of the government on the property of the citizen, and with the other to bestow it upon favored individuals to aid private enterprises and build up private fortunes, is none the less a robbery because it is done under the forms of law and is called taxation. This is not legislation. It is a decree under legislative forms.

Nor is it taxation. ‘A tax,’ says Webster’s Dictionary, ‘is a rate or sum of money assessed on the person or property of a citizen by government for the use of the nation or State.’ ‘Taxes are burdens or charges imposed by the Legislature upon persons or property to raise money for public purposes.’ Cooley, Const. Lim., 479.

Coulter, J., in Northern Liberties v. St. John’s Church, 13 Pa.St. 104 says, very forcibly, ‘I think the common mind has everywhere taken in the understanding that taxes are a public imposition, levied by authority of the government for the purposes of carrying on the government in all its machinery and operations—that they are imposed for a public purpose.’ See, also Pray v. Northern Liberties, 31 Pa.St. 69; Matter of Mayor of N.Y., 11 Johns., 77; Camden v. Allen, 2 Dutch., 398; Sharpless v. Mayor, supra; Hanson v. Vernon, 27 Ia., 47; Whiting v. Fond du Lac, supra.”

[Loan Association v. Topeka, 20 Wall. 655 (1874)]- If they try to pay you more than you paid them, they must make you into a public officer to do so to avoid the prohibition of the case above. In doing so, they in most cases must illegally establish a public office and in effect use "benefits" to criminally bribe you to illegally impersonate such an office. See The "Trade or Business" Scam, Form #05.001 for details.

- Paying you back what was originally your own money and NOTHING more is not a "benefit" or even a loan by them to you. If anything, it is a temporary loan by you to them! And it’s an unjust loan because they don't have to pay interest!

- Since you are the real lender, then you are the only real party who can make rules against them and not vice versa. See Article 4, Section 3, Clause 2 of the Constitution for where the ability to make those rules comes from.

- All franchises are contracts that require mutual consideration and mutual obligation to be enforceable. Since government isn't contractually obligated to provide the main consideration, which is "benefits" and isn't obligated to provide ANYTHING that is truly economically valuable beyond that, then the "contract" or "compact" is unenforceable against you and can impose no obligations on you based on mere equitable principals of contract law.

“We must conclude that a person covered by the Act has not such a right in benefit payments… This is not to say, however, that Congress may exercise its power to modify the statutory scheme free of all constitutional restraint.”

[Flemming v. Nestor, 363 U.S. 603 (1960)]"... railroad benefits, like social security benefits, are not contractual and may be altered or even eliminated at any time."

[United States Railroad Retirement Board v. Fritz, 449 U.S. 166 (1980)][SEDM Disclaimer, Section 4.10: Franchise; https://sedm.org/disclaimer.htm]

It is precisely the above objections that explain why the Bible describes the Social Security Number and Taxpayer Identification Number as “The Mark of the Beast”. See:

|

Social Security: Mark of the Beast, Form #11.407 https://sedm.org/Forms/FormIndex.htm |

So long as the government “benefits” are treated essentially as VOLUNTARY PRIVATE business activity not protected by official, sovereign, or judicial immunity and the government has to meet the same standards of proof in enforcing the contract as any private company, and must do so in a Judicial Branch Article III court rather than an Executive Branch Article I or Article IV, court, then we wouldn’t have a problem with offering government “benefits” or any other type of government contracts. The problem is that the corrupt government mafia NEVER either recognizes or protects your right to NOT participate, like any private company would have to. Imagine a private company that could force EVERYONE on the planet to buy their product and a court system that enforced their tyrannical right to do so, as is the case currently with government “benefits”.

This condition described above where government acts as a PRIVATE party in commerce and equity is described by the Clearfield Doctrine of the U.S. Supreme Court:

See also Clearfield Trust Co. v. United States, 318 U.S. 363, 369 (1943) ("`The United States does business on business terms'") (quoting United States v. National Exchange Bank of Baltimore, 270 U.S. 527, 534 (1926)); Perry v. United States, supra at 352 (1935) ("When the United States, with constitutional authority, makes contracts, it has rights and incurs responsibilities similar to those of individuals who are parties to such instruments. There is no difference . . . except that the United States cannot be sued without its consent") (citation omitted); United States v. Bostwick, 94 U.S. 53, 66 (1877) ("The United States, when they contract with their citizens, are controlled by the same laws that govern the citizen in that behalf"); Cooke v. United States, 91 U.S. 389, 398 (1875) (explaining that when the United States "comes down from its position of sovereignty, and enters the domain of commerce, it submits itself to the same laws that govern individuals there").

See Jones, 1 Cl.Ct. at 85 ("Wherever the public and private acts of the government seem to commingle, a citizen or corporate body must by supposition be substituted in its place, and then the question be determined whether the action will lie against the supposed defendant"); O'Neill v. United States, 231 Ct.Cl. 823, 826 (1982) (sovereign acts doctrine applies where, "[w]ere [the] contracts exclusively between private parties, the party hurt by such governing action could not claim compensation from the other party for the governing action"). The dissent ignores these statements (including the statement from Jones, from which case Horowitz drew its reasoning literally verbatim), when it says, post at 931, that the sovereign acts cases do not emphasize the need to treat the government-as-contractor the same as a private party.

[United States v. Winstar Corp., 518 U.S. 839 (1996) ]

To impute or enforce sovereign, official, or judicial immunity to any government civil statutory privilege is to abuse the courts to enforce SUPERIOR or SUPERNATURAL powers to government, makes the government into an object of religious idolatry, and violates the First Amendment by creating a secular civil religion described in the following document:

|

Socialism: The New American Civil Religion, Form #05.016 https://sedm.org/Forms/FormIndex.htm |

Real law and freedom itself require that ALL are treated equally in all respects by EVERY court and that there ARE no franchises or “franchise courts”. We prove this in:

- Foundations of Freedom, Video 1, Form #12.021

https://sedm.org/Forms/FormIndex.htm - Requirement for Equal Protection and Equal Treatment, Form #05.033

https://sedm.org/Forms/FormIndex.htm - What is “Law”?, Form #05.048

https://sedm.org/Forms/FormIndex.htm

Government franchises are the MAIN method of destroying equality, corrupting public servants, and replacing government with a state-sponsored civil religion in violation of the First Amendment.

So, before the reader closes their mind and their ears and refuses to read the remainder of this document, please prayerfully consider the content of this section and the EQUALITY and LEGAL JUSTICE it mandates.

“Evil men do not understand justice, But those who seek the Lord understand all.”

[Prov. 28:5, Bible, NKJV]"Justice is the end of government. It is the end of civil society. It ever has been, and ever will be pursued, until it be obtained, or until liberty be lost in the pursuit."

[The Federalist No. 51 (1788), James Madison]“The violence of the wicked will destroy them, because they refuse to do justice.”

[Prov. 21:7, Bible, NKJV]

3. Social Security Numbers (SSNs) and Taxpayer Identification Numbers (TINs) are what the FTC calls a “franchise mark”

The Federal Trade Commission (F.T.C.) has defined a commercial franchise as follows:

“. . .a commercial business arrangement [e.g. a STATUTORY “trade or business” under 26 U.S.C. §7701(a)(26)] is a “franchise” if it satisfies three definitional elements. Specifically, the franchisor must:

(1) promise to provide a trademark or other commercial symbol [e.g. the STATUTORY Social Security Number or Taxpayer Identification Number];

(2) promise to exercise significant control or provide significant assistance in the operation of the business [e.g. enforcement of the franchise “code” such as the Internal Revenue Code Subtitles A and C]; and

(3) require a minimum payment of at least $500 during the first six months of operations [e.g. tax refunds annually, deductions most Americans DO NOT need because of EXCLUSIONS in 26 U.S.C. §872 because not from GEOGRAPHICAL “U.S.”, stimulus checks, etc].”

[FTC Franchise Rule Compliance Guide, May 2008, p. 1;

SOURCE: http://business.ftc.gov/documents/bus70-franchise-rule-compliance-guide]

In the context of the above document, the “Social Security Number” or “Taxpayer Identification Number” function essentially as what the FTC calls a “franchise mark”. It behaves as what we call a “de facto license” to represent Caesar as a public officer:

"A franchise entails the right to operate a business that is "identified or associated with the franchisor's trademark, or to offer, sell, or distribute goods, services, or commodities that are identified or associated with the franchisor's trademark." The term "trademark" is intended to be read broadly to cover not only trademarks, but any service mark, trade name, or other advertising or commercial symbol. This is generally referred to as the "trademark" or "mark" element.

The franchisor [the government] need not own the mark itself, but at the very least must have the right to license the use of the mark to others. Indeed, the right to use the franchisor's mark in the operation of the business - either by selling goods or performing services identified with the mark or by using the mark, in whole or in part, in the business' name - is an integral part of franchising. In fact, a supplier can avoid Rule coverage of a particular distribution arrangement by expressly prohibiting the distributor from using its mark."

[FTC Franchise Rule Compliance Guide, May 2008;

SOURCE: http://business.ftc.gov/documents/bus70-franchise-rule-compliance-guide]

The nature of Social Security Numbers as a franchise mark is implemented as follows from a legal perspective:

- Like all contracts or agreements, franchises, or what is sometimes called “privileges” or “quasi-contracts”[1] by the U.S. Supreme court, require:

- An offer as the “Merchant” under U.C.C. §2-104(1). Sometimes also called a Creditor or Seller.

- A voluntary acceptance as the “Buyer” under U.C.C. §2-103(1)(a). Sometimes also called a Debtor or Borrower.

- Valuable consideration provided by the “Merchant” to the “Buyer” in the form of property or rights or services. Without consideration there can be no obligation or contract.

- Mutual assent or understanding.

- The absence of duress. This also implies a right to quit or to waive all or any portion of the “benefits” of the relationship and the corresponding obligation to pay for those future “benefits”.

Invito beneficium non datur.

No one is obliged to accept a benefit against his consent. Dig. 50, 17, 69. But if he does not dissent he will be considered as assenting. Vide Assent.

Potest quis renunciare pro se, et suis, juri quod pro se introductum est.

A man may relinquish, for himself and his heirs, a right which was introduced for his own benefit. See 1 Bouv. Inst. n. 83.

Quilibet potest renunciare juri pro se inducto.

Any one may renounce a law introduced for his own benefit. To this rule there are some exceptions. See 1 Bouv. Inst. n. 83.

[Bouvier’s Maxims of Law, 1856;

SOURCE: http://famguardian.org/Publications/BouvierMaximsOfLaw/BouviersMaxims.htm]

- The franchise mark may be a number and an associated civil status label such as an SSN or TIN, "person", taxpayer", "citizen", "resident", etc. However, the NAME of the number or civil status, meaning “SSN” or “TIN” in this case, must DERIVE from the franchise contract DEFINED by the Merchant. Another way of stating this is that under the Uniform Commercial Code, the language of the offer and the language of the acceptance MUST be the same and the parties must agree on a SINGLE definition for all terms. Without a common definition, there can be no assent because the parties have a different understanding about what is being offered or accepted. See:

- This Form is Your Form, Mark Desantis

http://www.youtube.com/embed/b6-PRwhU7cg - Mirror Image Rule, Mark Desantis

http://www.youtube.com/embed/j8pgbZV757w

- This Form is Your Form, Mark Desantis

- The right of the Merchant to prescribe the terms of the contract or agreement derives from the consideration, services, or valuable property he brings to the relationship that the BUYER wants.

- In the case of the government, that authority derives from Article 4, Section 3, Clause 2 of the United States Constitution:

U.S. Constitution, Article IV § 3 (2).

The Congress shall have Power to dispose of and make all needful Rules and Regulations respecting the Territory or other Property belonging to the United States [***]

- In the case of the otherwise PRIVATE human being and BUYER, INCLUDING governments, the authority to make rules and definitions for the terms they use on any form, INCLUDING government forms, is the control over their own private property that they are lending or selling or renting to the government.

“The State in such cases exercises no greater right than an individual may exercise over the use of his own property when leased or loaned to others. The conditions upon which the privilege shall be enjoyed being stated or implied in the legislation authorizing its grant, no right is, of course, impaired by their enforcement. The recipient of the privilege, in effect, stipulates to comply with the conditions. It matters not how limited the privilege conferred, its acceptance implies an assent to the regulation of its use and the compensation for it.”

[Munn v. Illinois, 94 U.S. 113 (1876) ]

- In the case of the government, that authority derives from Article 4, Section 3, Clause 2 of the United States Constitution:

- Once consent or agreement is voluntarily procured, the parties VOLUNTARILY acquire a “civil status” (Form #13.008) under the terms of the franchise agreement or contract or parole agreement, such as “person”, “taxpayer”, “benefit recipient”, “participant”, etc. This right to volunteer is protected by your unalienable right to contract and your First Amendment right to politically and legally associate. Be careful HOW you exercise your right to contract! and associate, because it's the MOST DANGEROUS right you have! Why?: Because it can literally DESTROY all of your other rights! This label or civil status (Form #13.008) is the object to which ALL statutory civil obligations against the Buyer and corresponding Rights of the Merchant, legally attach. If the status was not voluntarily accepted, there can be no enforceable contract or agreement. The ONLY way to defeat such a contract or agreement is to do one of the following:

- To claim that you were operating in a representative capacity and that your Principle expressly FORBIDS such consent in your delegation order. For instance, you can claim that you are God’s representative 24 hours a day and 7 days a week under the First Amendment, and that your delegation of authority order, the Bible, forbids you to consent as God’s representative to any such enticements.

- 4.2. To claim that the rights alienated by the franchise are UNALIENABLE per the Declaration of Independence, and thus cannot be given away to a REAL DE JURE GOVERNMENT even WITH consent. A real, de jure government established ONLY to protect PRIVATE property and PRIVATE rights cannot be allowed to violate the purpose of its creation by establishing a profitable business called a franchise whose main purpose is to DESTROY such rights and convert all property into PUBLIC property or PUBLIC rights. That would violate the intent of the Constitution, in fact.

- To identify yourself as being UNELIGIBLE at the time of making application. For proof of this in the case of Social Security, see:

Why You Aren’t Eligible for Social Security, Form #06.001

https://sedm.org/Forms/FormIndex.htm

- The SOURCE of the definition of the LABEL on the license number or franchise mark establishes WHO the “Merchant” is.

- If you accept the STATUTORY definition of “SSN”, then GOVERNMENT is the Merchant and YOU are the Buyer.

- If you make your OWN definition for “SSN’ or “TIN” on the government form or application and reject the STATUTORY definition, even though it uses the same LABEL (e.g. “SSN” or “TIN”), then YOU are the Merchant and GOVERNMENT is the Buyer. In other words, changing the definitions replaces the original Merchant’s offer with a COUNTEROFFER by the Buyer. The Buyer then becomes the NEW Merchant and the roles switch.

- If the original Merchant then responds to your definition of terms by saying that you have to accept THEIR definition to get the “benefit” of the franchise, you simply respond that you have a right NOT to receive a “benefit” and that the only thing you want is for the government to LEAVE YOU ALONE, which is what “justice” itself is defined as. For instance, having government ID that does not impute a civil statutory status to you such as “citizen”, “resident”, or “person” has the effect of allowing you to be LEFT ALONE and not attaching any enforcement authority or “benefit” to you. By doing this, you are preventing what we call “bundling”, where civil obligations are attached to the receipt of some government service by associating you with a civil statutory status that you don’t want. More on this in:

Your Exclusive Right to Declare and Establish Your Civil Status, Form #13.008

https://sedm.org/Forms/FormIndex.htm - If the government Merchant then tries to advise you what to put on the form, or refuses to accept your form with your definitions, then they are discriminating against you, and also criminally tampering with a witness, because most government forms are signed under penalty of perjury as court-admissible legal evidence.

- A prospective Buyer SUBMITTING a government form is the CREATOR of the form. The CREATOR is always the OWNER of the thing, and thus the ONLY one who can define what it means. See:

Hierarchy of Sovereignty: The Power to Create is the Power to Tax, Family Guardian Fellowship

https://famguardian.org/Subjects/Taxes/Remedies/PowerToCreate.htm - The only Party to the transaction who can “make rules” or definitions relating to property is the OWNER of that property. That’s what legal “ownership” is defined as, in fact: CONTROL and the right to exclude any and all others from using or benefitting from a thing.

- If a form is required to be submitted by the Buyer to the merchant to receive custody or eligibility of specific property or rights under a franchise, the CREATOR of a form controls the outcome of the transaction rather than the author of the form. By “CREATOR” we mean the person who SUBMITS AND SIGNS the form, not the person who PROVIDES or offers the form to use in the application process. The submitter is the ONLY one who can define the meaning or context of the terms of the form. The courts have held that you cannot trust ANYTHING on a government form or ANYTHING an executive branch employee says. Thus, you can’t trust that you KNOW what the definition or context of the terms are. Thus you are OBLIGATED to define them in a way that benefits and protects ONLY YOU. See:

Federal Courts and the IRS' Own IRM Say the IRS is NOT RESPONSIBLE for its Actions or Its Words, or for Following Its Own Written Procedures, Family Guardian Fellowshiphttps://famguardian.org/Subjects/Taxes/Articles/IRSNotResponsible.htm - If you want to FLIP the relationship of the parties so that YOU become the Merchant and government becomes the Buyer, simply define the term “SSN” or “TIN” on government forms as NOT the one in statutes, but one issued by YOU that makes government the Buyer. Here is an example:

NOTES:

1. All terms used on this form OTHER than "Social Security Number" shall be construed in their statutory sense. This is especially true in the case of money or finance. They are not used in their private, ordinary, or common law sense. The term "Social Security Number" identifies a PRIVATE number owned and issued by the Submitter to the government under license and franchise. It is not a number identified in any governments statute and does not pertain to anyone eligible to receive Social Security Benefits and may not be used to indicate or imply eligibility to receive said benefits. The license for the use of the number for use outside of the VA for any purpose, and especially civil or criminal enforcement purpose, is identified below and incorporated by reference herein. Acceptance or use of said number for such purpose constitutes constructive or implied consent to said agreement by all those so using said number:

Injury Defense Franchise and Agreement, Form #06.027; https://sedm.org/Forms/06-AvoidingFranch/InjuryDefenseFranchise.pdf.This provision is repeated Section 0 in the attached form entitled Why It is Illegal for Me to Request or Use a Taxpayer Identification Number, Form #04.205. The reason for this provision is that everyone who asks for such number refers to them as "MINE" or "MY" or "YOUR", meaning that it is MY absolutely owned PRIVATE property. Therefore I am simply documenting the fact that it is my absolutely owned private property as a private human not affiliated with the government. All private property can be used as a basis to place conditions on its use or else it isn't mine. That's what "ownership" implies in a legal sense. Congress does the same thing with ITS property under Article 4, Section 3, Clause 2, and I am simply carrying out exactly the authority THEY claim over THEIR property in the same manner as them.

[Veterans Administration Benefit Application, Form #06.041, https://sedm.org/Forms/FormIndex.htm]Why can you emulate the government’s tactics in doing this? Because ALL are treated equally under real law, and because if the government can CREATE obligations against you essentially by using equivocation to make you look like someone who is eligible, even if you are not, then you can use the SAME equivocation to AVOID becoming eligible and make THEM eligible for your ANTI-FRANCHISE. Otherwise, the constitutional requirement for equal protection and equal treatment is violated. Fight fire with fire! For proof, see:

Requirement for Equal Protection and Equal Treatment, Form #05.033

https://sedm.org/Forms/FormIndex.htm - As far as NATIONAL franchises, Congress is FORBIDDEN from establishing excise taxable franchises or privileges such as the income tax within the exclusive jurisdiction of a constitutional state of the Union. Thus, the ONLY place they can establish them is within FEDERAL AREAS subject to the exclusive jurisdiction of Congress:

“Thus, Congress having power to regulate commerce with foreign nations, and among the several States, and with the Indian tribes, may, without doubt, provide for granting coasting licenses, licenses to pilots, licenses to trade with the Indians, and any other licenses necessary or proper for the exercise of that great and extensive power; and the same observation is applicable to every other power of Congress, to the exercise of which the granting of licenses may be incident. All such licenses confer authority, and give rights to the licensee.

But very different considerations apply to the internal commerce or domestic trade of the States. Over this commerce and trade Congress has no power of regulation nor any direct control. This power belongs exclusively to the States. No interference by Congress with the business of citizens transacted within a State is warranted by the Constitution, except such as is strictly incidental to the exercise of powers clearly granted to the legislature. The power to authorize a business within a State is plainly repugnant to the exclusive power of the State over the same subject. It is true that the power of Congress to tax is a very extensive power. It is given in the Constitution, with only one exception and only two qualifications. Congress cannot tax exports, and it must impose direct taxes by the rule of apportionment, and indirect taxes by the rule of uniformity. Thus limited, and thus only, it reaches every subject, and may be exercised at discretion. But, it reaches only existing subjects. Congress cannot authorize [e.g. LICENSE using a Social Security Number] a trade or business within a State in order to tax it.”

[License Tax Cases, 401H72 U.S. 462, 18 L.Ed. 497, 5 Wall. 462, 2 A.F.T.R. 2224 (1866) ] - For more about tricks with definitions, changing the context, and the equivocation that changing the context of words on a form does, see:

Avoiding Traps on Government Forms, Form #12.023

https://sedm.org/Forms/FormIndex.htm

This same SSN or TIN “ franchise mark” is what the Bible calls “the mark of the beast”. It defines “the Beast” as the government or civil rulers:

"And I saw the beast, the kings of the earth, and their armies, gathered together to make war against Him who sat on the horse and against His army."

[Rev. 19:19, Bible, NKJV]“He [the government BEAST] causes all, both small and great, rich and poor, free and slave, to receive a mark on their right hand or on their foreheads, 17 and that no one may buy or sell except one who has the mark or[f] the name of the beast, or the number of his name.

[Rev. 13:16-17, Bible, NKJV]

The “business” that is “operated” or “licensed” by THE BEAST in statutes is called a “trade or business” which is defined as follows:

26 U.S.C. Sec. 7701(a)(26)

"The term 'trade or business' includes the performance of the functions of a public office."

Those engaged in “the trade or business” franchise activity are officers of Caesar and have fired God as their civil protector. By becoming said public officers or officers of Caesar, they have violated the FIRST COMMANDMENT of the Ten Commandments, because they are “serving other gods”, and the pagan god they serve is a man:

“You shall have no other gods [including governments or civil rulers] before Me.

“You shall not make for yourself a carved image—any likeness of anything that is in heaven above, or that is in the earth beneath, or that is in the water under the earth; you shall not bow down to them nor serve them. For I, the Lord your God, am a jealous God, visiting the iniquity of the fathers upon the children to the third and fourth generations of those who hate Me, but showing mercy to thousands, to those who love Me and keep My commandments.

[Exodus 20:3-6, Bible, NKJV]

By “bowing down” as indicated above, the Bible means that you cannot become UNEQUAL or especially INFERIOR to any government or civil ruler under the civil law. In other words, you cannot surrender your equality and be civilly governed by any government or civil ruler under the Roman system of jus civile, civil law, or civil “statutes”. That is not to say that you are lawless or an “anarchist” by any means, because you are still accountable under criminal law, equity, and the common law in any court. All civil statutory codes make the government superior and you inferior so you can’t consent to a domicile and thereby become subject to it. The word “subjection” in the following means INFERIORITY:

“Protectio trahit subjectionem, subjectio projectionem.

Protection draws to it subjection, subjection, protection. Co. Litt. 65.”

[Bouvier’s Maxims of Law, 1856;

SOURCE: http://famguardian.org/Publications/BouvierMaximsOfLaw/BouviersMaxims.htm]

Below are ways one become subject to Caesar’s civil statutory “codes” and civil franchises as a “subject”, and thereby surrenders their equality to engage in government idolatry:

- Domicile by choice: Choosing domicile within a specific jurisdiction.

- Domicile by operation of law. Also called domicile of necessity:

- Representing an entity that has a domicile within a specific jurisdiction even though not domiciled oneself in said jurisdiction. For instance, representing a federal corporation as a public officer of said corporation, even though domiciled outside the federal zone. The authority for this type of jurisdiction is, for instance, Federal Rule of Civil Procedure 17(b).

- Becoming a dependent of someone else, and thereby assuming the same domicile as that of your caregiver. For instance, being a minor and dependent and having the same civil domicile as your parents. Another example is becoming a government dependent and assuming the domicile of the government paying you the welfare check.

- Being committed to a prison as a prisoner, and thereby assuming the domicile of the government owning or funding the prison.

Those who violate the First Commandment by doing any of the above become subject to the civil statutory franchises or codes. They thereby commit the following form of idolatry because they are nominating a King to be ABOVE them rather than EQUAL to them under the common law:

Then all the elders of Israel gathered together and came to Samuel at Ramah, and said to him, “Look, you are old, and your sons do not walk in your ways. Now make us a king to judge us like all the nations [and be OVER them]”.

But the thing displeased Samuel when they said, “Give us a king to judge us.” So Samuel prayed to the Lord. And the Lord said to Samuel, “Heed the voice of the people in all that they say to you; for they have rejected Me [God], that I should not reign over them. According to all the works which they have done since the day that I brought them up out of Egypt, even to this day—with which they have forsaken Me and served other gods [Kings, in this case]—so they are doing to you also [government becoming idolatry]. Now therefore, heed their voice. However, you shall solemnly forewarn them, and show them the behavior of the king who will reign over them.”

So Samuel told all the words of the LORD to the people who asked him for a king. And he said, “This will be the behavior of the king who will reign over you: He will take [STEAL] your sons and appoint them for his own chariots and to be his horsemen, and some will run before his chariots. He will appoint captains over his thousands and captains over his fifties, will set some to plow his ground and reap his harvest, and some to make his weapons of war and equipment for his chariots. He will take [STEAL] your daughters to be perfumers, cooks, and bakers. And he will take [STEAL] the best of your fields, your vineyards, and your olive groves, and give them to his servants. He will take [STEAL] a tenth of your grain and your vintage, and give it to his officers and servants. And he will take [STEAL] your male servants, your female servants, your finest young men, and your donkeys, and put them to his work [as SLAVES]. He will take [STEAL] a tenth of your sheep. And you will be his servants. And you will cry out in that day because of your king whom you have chosen for yourselves, and the LORD will not hear you in that day.”

Nevertheless the people refused to obey the voice of Samuel; and they said, “No, but we will have a king over us, that we also may be like all the nations, and that our king may judge us and go out before us and fight our battles.”

[1 Sam. 8:4-20, Bible, NKJV]

In support of this section, the following evidence is provided for use in court which PROVES that those who use SSNs or TINs are considered to be and MUST, by law, be considered to be public officers:

- The U.S. Supreme Court has held in the case of the State Action doctrine that those receiving government “benefits” are to be regarded as state actors, meaning public officers.

“One great object of the Constitution is to permit citizens to structure their private relations as they choose subject only to the constraints of statutory or decisional law. [500 U.S. 614, 620]

To implement these principles, courts must consider from time to time where the governmental sphere [e.g. “public purpose” and “public office”] ends and the private sphere begins. Although the conduct of private parties lies beyond the Constitution's scope in most instances, governmental authority may dominate an activity to such an extent that its participants must be deemed to act with the authority of the government and, as a result, be subject to constitutional constraints. This is the jurisprudence of state action, which explores the "essential dichotomy" between the private sphere and the public sphere, with all its attendant constitutional obligations. Moose Lodge, supra, at 172. “

[. . .]

Given that the statutory authorization for the challenges exercised in this case is clear, the remainder of our state action analysis centers around the second part of the Lugar test, whether a private litigant, in all fairness, must be deemed a government actor in the use of peremptory challenges. Although we have recognized that this aspect of the analysis is often a fact-bound inquiry, see Lugar, supra, 457 U.S. at 939, our cases disclose certain principles of general application. Our precedents establish that, in determining whether a particular action or course of conduct is governmental in character, it is relevant to examine the following: the extent to which the actor relies on governmental assistance and benefits, see Tulsa Professional Collection Services, Inc. v. Pope, 485 U.S. 478 (1988); Burton v. Wilmington Parking Authority, 365 U.S. 715 (1961); whether the actor is performing a traditional governmental function, see Terry v. Adams, 345 U.S. 461 (1953); Marsh v. Alabama, 326 U.S. 501 (1946); cf. San Francisco Arts & Athletics, Inc. v. United States Olympic [500 U.S. 614, 622] Committee, 483 U.S. 522, 544 -545 (1987); and whether the injury caused is aggravated in a unique way by the incidents of governmental authority, see Shelley v. Kraemer, 334 U.S. 1 (1948). Based on our application of these three principles to the circumstances here, we hold that the exercise of peremptory challenges by the defendant in the District Court was pursuant to a course of state action.

[Edmonson v. Leesville Concrete Company, 500 U.S. 614 (1991)] - The U.S. Supreme Court has held that government identifying numbers may be mandated against those seeking to receive government “benefits”.

Appellees raise a constitutional challenge to two features of the statutory scheme here.[4] They object to Congress' requirement that a state AFDC plan "must . . . provide (A) that, as a condition of eligibility under the plan, each applicant for or recipient of aid shall furnish to the State agency his social security account number." 42 U. S. C. § 602(a)(25) (emphasis added). They also object to Congress' requirement that "such State agency shall utilize such account numbers. . . in the administration of such plan." Ibid. (emphasis added).[5] We analyze each of these contentions, turning to the latter contention first.

Our cases have long recognized a distinction between the freedom of individual belief, which is absolute, and the freedom of individual conduct, which is not absolute. This case implicates only the latter concern. Roy objects to the statutory requirement that state agencies "shall utilize" Social Security numbers not because it places any restriction on what he may believe or what he may do, but because he believes the use of the number may harm his daughter's spirit.

Never to our knowledge has the Court interpreted the First Amendment to require the Government itself to behave in ways that the individual believes will further his or her spiritual development or that of his or her family. The Free Exercise Clause simply cannot be understood to require the Government to conduct its own internal affairs in ways that comport with the religious beliefs of particular citizens. Just as the Government may not insist that appellees engage in [476 U.S. 693, 700] any set form of religious observance, so appellees may not demand that the Government join in their chosen religious practices by refraining from using a number to identify their daughter. "[T]he Free Exercise Clause is written in terms of what the government cannot do to the individual, not in terms of what the individual can extract from the government." Sherbert v. Verner, 374 U.S. 398, 412 (1963) (Douglas, J., concurring).

As a result, Roy may no more prevail on his religious objection to the Government's use of a Social Security number for his daughter than he could on a sincere religious objection to the size or color of the Government's filing cabinets. The Free Exercise Clause affords an individual protection from certain forms of governmental compulsion; it does not afford an individual a right to dictate the conduct of the Government's internal procedures.

[Bowen v. Roy, 476 U.S. 693 (1986)]

_____________________________

FOOTNOTES:

[4] They also raise a statutory argument — that the Government's denial of benefits to them constitutes illegal discrimination on the basis of religion or national origin. See 42 U. S. C. §2000d; 7 U. S. C. §2011. We find these claims to be without merit.

[5] The Food Stamp program restrictions that appellees challenge contain restrictions virtually identical to those in the AFDC program quoted in the text. See 7 U. S. C. § 2025(e). - The U.S. Supreme Court has also held that no one can RECEIVE government payments without actually WORKING for the government. Any abuse of the taxing power to redistribute wealth is unconstitutional.

To lay, with one hand, the power of the government on the property of the citizen, and with the other to bestow it upon favored individuals to aid private enterprises and build up private fortunes, is none the less a robbery because it is done under the forms of law and is called taxation. This is not legislation. It is a decree under legislative forms.

Nor is it taxation. ‘A tax,’ says Webster’s Dictionary, ‘is a rate or sum of money assessed on the person or property of a citizen by government for the use of the nation or State.’ ‘Taxes are burdens or charges imposed by the Legislature upon persons or property to raise money for public purposes.’ Cooley, Const. Lim., 479.

Coulter, J., in Northern Liberties v. St. John’s Church, 13 Pa.St. 104 says, very forcibly, ‘I think the common mind has everywhere taken in the understanding that taxes are a public imposition, levied by authority of the government for the purposes of carrying on the government in all its machinery and operations—that they are imposed for a public purpose.’ See, also Pray v. Northern Liberties, 31 Pa.St. 69; Matter of Mayor of N.Y., 11 Johns., 77; Camden v. Allen, 2 Dutch., 398; Sharpless v. Mayor, supra; Hanson v. Vernon, 27 Ia., 47; Whiting v. Fond du Lac, supra.”

[Loan Association v. Topeka, 20 Wall. 655 (1874)]

________________________________________________________________________________

"A tax, in the general understanding of the term and as used in the constitution, signifies an exaction for the support of the government. The word has never thought to connote the expropriation of money from one group for the benefit of another."

[U.S. v. Butler, 297 U.S. 1 (1936)] - Those eligible to receive government “benefits” are identified in Title 5 of the U.S. Code as “federal personnel”.

TITLE 5 > PART I > CHAPTER 5 > SUBCHAPTER II > § 552a

§552a. Records maintained on individuals(a) Definitions.— For purposes of this section—

(13) the term “Federal personnel” means officers and employees of the Government of the United States, members of the uniformed services (including members of the Reserve Components), individuals entitled to receive immediate or deferred retirement benefits under any retirement program of the Government of the United States (including survivor benefits).

- Those not subject to the Internal Revenue Code and a “foreign estate” are described as NOT engaged in a “trade or business”, meaning a public office.

TITLE 26 > Subtitle F > CHAPTER 79 > § 7701

§ 7701. Definitions(31) Foreign estate or trust

(A) Foreign estate The term “foreign estate” means an estate the income of which, from sources without the United States which is not effectively connected with the conduct of a trade or business within the United States, is not includible in gross income under subtitle A.

(B) Foreign trust The term “foreign trust” means any trust other than a trust described in subparagraph (E) of paragraph (30). - Those who work for the government or receive the “benefit” of any government civil statute are presumed to waive ALL of their constitutional rights and cannot invoke ANY of them in court.

“The principle is invoked that one who accepts the benefit of a statute cannot be heard to question its constitutionality. Great Falls Manufacturing Co. v. Attorney General, 124 U.S. 581, 8 S.Ct. 631, 31 L.Ed. 527; Wall v. Parrot Silver & Copper Co., 244 U.S. 407, 37 S.Ct. 609, 61 L.Ed. 1229; St. Louis, etc., Co., v. George C. Prendergast Const. Co., 260 U.S. 469, 43 S.Ct. 178, 67 L.Ed. 351.

[. . .]

6. The Court will not pass upon the constitutionality of a statute at the instance of one who has availed himself of its benefits. Great Falls Mfg. Co. v. Attorney General, 124 U.S. 581, 8 S.Ct. 631, 31 L.Ed. 527; Wall v. Parrot Silver & Copper Co., 244 U.S. 407, 411, 412, 37 S.Ct. 609, 61 L.Ed. 1229; St. Louis Malleable Casting Co. v. Prendergast Construction Co., 260 U.S. 469, 43 S.Ct. 178, 67 L.Ed. 351.”

[Ashwander v. T.V.A., 297 U.S. 288, 56 S.Ct. 466, 80 L.Ed. 688 (1936)]

_____________________________________________________________________________________

“It is not open to question that one who has acquired rights of property necessarily based upon a statute may not attack that statute as unconstitutional, for he cannot both assail it and rely upon it in the same proceeding. *528 Hurley v. Commission of Fisheries, 257 U. S. 223, 225, 42 S.Ct. 83, 66 L.Ed. 206.”

[Frost v. Corporation Commission, 278 U.S. 515, 49 S.Ct. 235 (U.S., 1929)]

Based on the preceding overwhelming evidence, the inference and conclusion that Social Security Numbers are regarded and treated as a de facto license to occupy a public office is inescapable. The taxation of the exercise of that office, in fact, is the main object of the entire Internal Revenue Code Subtitles A and C. It is de facto, because those exercising said office do so illegally and unconstitutionally in the vast majority of cases.

FOOTNOTES:

[1] Below is an example from the U.S. Supreme Court in the case of the “trade or business” excise taxable income tax franchise:

“Even if the judgment is deemed to be colored by the nature of the obligation whose validity it establishes, and we are free to re-examine it, and, if we find it to be based on an obligation penal in character, to refuse to enforce it outside the state where rendered, see Wisconsin v. Pelican Insurance Co., 127 U.S. 265 , 292, et seq. 8 S.Ct. 1370, compare Fauntleroy v. Lum, 210 U.S. 230 , 28 S.Ct. 641, still the obligation to pay taxes is not penal. It is a statutory liability, quasi contractual in nature, enforceable, if there is no exclusive statutory remedy, in the civil courts by the common-law action of debt or indebitatus assumpsit. United States v. Chamberlin, 219 U.S. 250 , 31 S.Ct. 155; Price v. United States, 269 U.S. 492 , 46 S.Ct. 180; Dollar Savings Bank v. United States, 19 Wall. 227; and see Stockwell v. United States, 13 Wall. 531, 542; Meredith v. United States, 13 Pet. 486, 493. This was the rule established in the English courts before the Declaration of Independence. Attorney General v. Weeks, Bunbury's Exch. Rep. 223; Attorney General v. Jewers and Batty, Bunbury's Exch. Rep. 225; Attorney General v. Hatton, Bunbury's Exch. Rep. [296 U.S. 268, 272] 262; Attorney General v. _ _, 2 Ans.Rep. 558; see Comyn's Digest (Title 'Dett,' A, 9); 1 Chitty on Pleading, 123; cf. Attorney General v. Sewell, 4 M.&W. 77. “

[Milwaukee v. White, 296 U.S. 268 (1935)]

4. Why Knowing about SSNs and TINs is VERY important

The subject of SSNs and TINs is VERY important to understanding how the income tax actually works. It is a tax upon the GOVERNMENT and ONLY the government. By “government” we mean “the United States” federal corporation. You have to JOIN that corporation as a public officer in most cases to be subject to the tax. The “United States” is defined as follows:

26 U.S. Code § 7701 – Definitions

(a)When used in this title, where not otherwise distinctly expressed or manifestly incompatible with the intent thereof—

(9)United States

The term “United States” when used in a geographical sense includes only the States and the District of Columbia.

(10)State

The term “State” shall be construed to include the District of Columbia, where such construction is necessary to carry out provisions of this title.

The regulations clarify the above definition of “United States” as follows:

26 CFR § 301.7701-7 - Trusts—domestic and foreign.

§ 301.7701-7 Trusts—domestic and foreign.(c) The court test—(1) Safe harbor. A trust satisfies the court test if—

(i) Court. The term court includes any federal, state, or local court.

(ii) The United States.

The term the United States is used in this section in a geographical sense. Thus, for purposes of the court test, the United States includes only the States and the District of Columbia. See section 7701(a)(9). Accordingly, a court within a territory or possession of the United States or within a foreign country is not a court within the United States.

There is the heart of the separation of powers, hidden in plain site in regulations that the IRS is the only one who ever reads. IRS publications and websites are the exoteric. The code and regs the esoteric. It does seem like they included (on purpose) the article "the" by including it in the italic styling (why not just wrap it in quotes like other terms in the code?)...yet they invoke the entire def of 26 U.S.C. §7701(a)(9) inline, and ALSO reference it. We find that interesting.

We think that understanding the entire Internal Revenue Code accurately really just comes down to what “United States” means in that context. Since it’s ONLY defined in a geographical sense, and since 26 C.F.R. §301.7701-7 mentions that United States is being used in a geographical sense, it opens up the floodgates, especially given the definition of American Employer in 26 U.S.C. §3121, that there are OTHER senses, not defined which can be presumed if its in the best interest of the taxpayer....and let the IRS or courts PROVE otherwise.

It certainly appears to us that only one of two possibilities are permitted as a definition for "the States" in 26 U.S.C. §7701(a)(9):

- "United States"=DC only from this. OR

- "The States" are those that consent to be treated AS IF they are within the jurisdiction of the I.R.C. BY COMPACT. This would be all the states that have income tax. SD, Florida, Texas, and Georgia excepted, of course, because they don't have income tax.

Item 2 above would seem to constitute a clear conspiracy to destroy the separation of powers at the heart of the constitution. See:

| Government Conspiracy to Destroy the Separation of Powers, Form #05.023 https://sedm.org/Forms/05-MemLaw/SeparationOfPowers.pdf |

This is the DEFAULT and ONLY geographical definition in the title. The rules of statutory construction and interpretation require that the law must give reasonable notice of all that is included to the reader, and that the reader cannot be required to guess or presume anything about meanings. So we'll punt and apply the first definition: DC only. This is the only thing consistent with the following SCOTUS ruling:

"Loughborough v. Blake, 5 Wheat. 317, 5 L.Ed. 98, was an action of trespass or, as appears by the original record, replevin, brought in the circuit court for the District of Columbia to try the right of Congress to impose a direct tax for general purposes on that District. 3 Stat. at L. 216, chap. 60. It was insisted that Congress could act in a double capacity: in one as legislating [182 U.S. 244, 260] for the states; in the other as a local legislature for the District of Columbia. In the latter character, it was admitted that the power of levying direct taxes might be exercised, but for District purposes only, as a state legislature might tax for state purposes; but that it could not legislate for the District under art. 1, 8, giving to Congress the power 'to lay and collect taxes, imposts, and excises,' which 'shall be uniform throughout the United States,' inasmuch as the District was no part of the United States. It was held that the grant of this power was a general one without limitation as to place, and consequently extended to all places over which the government extends; and that it extended to the District of Columbia as a constituent part of the United States. The fact that art. 1 , 2, declares that 'representatives and direct taxes shall be apportioned among the several states . . . according to their respective numbers' furnished a standard by which taxes were apportioned, but not to exempt any part of the country from their operation. 'The words used do not mean that direct taxes shall be imposed on states only which are represented, or shall be apportioned to representatives; but that direct taxation, in its application to states, shall be apportioned to numbers.' That art. 1, 9, 4, declaring that direct taxes shall be laid in proportion to the census, was applicable to the District of Columbia, 'and will enable Congress to apportion on it its just and equal share of the burden, with the same accuracy as on the respective states. If the tax be laid in this proportion, it is within the very words of the restriction. It is a tax in proportion to the census or enumeration referred to.' It was further held that the words of the 9th section did not 'in terms require that the system of direct taxation, when resorted to, shall be extended to the territories, as the words of the 2d section require that it shall be extended to all the states. They therefore may, without violence, be understood to give a rule when the territories shall be taxed, without imposing the necessity of taxing them.'

[Downes v. Bidwell, 182 U.S. 244 (1901), https://caselaw.findlaw.com/court/us-supreme-court/182/244.html]

So the I.R.C. Subtitle A income tax IS and always has been a tax on the government and its offices, and those who volunteer for those offices. The above says it is "without limitation as to place" and "wherever the GOVERNMENT extends".

- The government consists of PROPERTY and OFFICES, which are also property. Government is not a physical thing but the property it owns often but not always is.

- The obligation to pay taxes attaches to government offices and property, which are both public property. It is, in effect, a rental fee for the beneficial use of government property. See:

Why Your Government is Either a Thief or You are a Public Officer for Income Tax Purposes, Form #05.008

https://sedm.org/Forms/05-MemLaw/WhyThiefOrPubOfficer.pdf - The office and the officer are separate and distinct. They cannot be lawfully connected without the consent of the officer as a volunteer.

How State Nationals Volunteer to Pay Income Tax, Form #08.024

https://sedm.org/Forms/08-PolicyDocs/HowYouVolForIncomeTax.pdf - The income tax is a franchise tax upon the OFFICE. That office is the "taxpayer", "citizen", "resident", etc, not the officer consensually FILLING the office.

- Taxes must be collected ONLY from property voluntarily attached to the office. The method of attachment is the SSN, which functions as a franchise mark as the FTC defines it. They cannot be collected from the PRIVATE property of the officer because it was never lawfully converted to public property with the consent of the owner. Administrative enforcement is ALWAYS limited to government/public property and never absolutely owned PRIVATE property. See:

Administrative State: Tactics and Defenses, Form #12.041

https://sedm.org/LibertyU/AdminState.pdf - When IRS does a levy under 26 U.S.C. §6331, the levy is upon INSTRUMENTALITIES of the government and not the PRIVATE officers filling the office. Formerly private property attached to the office by connecting it with the franchise mark is the ONLY lawful subject of the levy. If the property isn't connected to the office with the franchise mark it can't be levied. See this document.

Levies aren't sent out on people who didn't voluntarily attach their earnings to the office by supplying a Form W-9 or Form W-4 containing the franchise mark. IRS can’t locate or levy the property until it is VOLUNTARILY enumerated.

IN CONCLUSION: Yes, the tax is ONLY upon the office and all formerly private property DONATED to a public use, a public office, and a public purpose by attaching a franchise mark to it. Unenumerated bank accounts are NEVER levied administratively. And YES, the tax is upon the PROPERTY of the government. Attaching the mark makes it property of the government. OF COURSE the corrupt covetous government has a right to lien an levy public property, which is what it is if you attach a franchise mark, whether you knew that or not.

“Men are endowed by their Creator with certain unalienable rights,-'life, liberty, and the pursuit of happiness;' and to 'secure,' not grant or create, these rights, governments are instituted. That property [or income] which a man has honestly acquired he retains full control of, subject to these limitations:[1] First, that he shall not use it to his neighbor's injury, and that does not mean that he must use it for his neighbor's benefit [e.g. SOCIAL SECURITY, Medicare, and every other public “benefit”];

[2] second, that if he devotes it to a public use, he gives to the public a right to control that use; and

[3] third, that whenever the public needs require, the public may take it upon payment of due compensation.”

[Budd v. People of State of New York, 143 U.S. 517 (1892)]

See item 2 above. "trade or business" under 26 U.S.C. §7701(a)(26)=public office=public use. SSN is only required of those engaged in a trade or business. 26 C.F.R. §301.6109-1(b).

26 CFR § 301.6109-1 - Identifying numbers

§ 301.6109-1 Identifying numbers.(b) Requirement to furnish one's own number—

(1) U.S. persons.

Every U.S. person who makes under this title a return, statement, or other document must furnish its own taxpayer identifying number as required by the forms and the accompanying instructions. A U.S. person whose number must be included on a document filed by another person must give the taxpayer identifying number so required to the other person on request. For penalties for failure to supply taxpayer identifying numbers, see sections 6721 through 6724. For provisions dealing specifically with the duty of employees with respect to their social security numbers, see § 31.6011(b)-2 (a) and (b) of this chapter (Employment Tax Regulations). For provisions dealing specifically with the duty of employers with respect to employer identification numbers, see § 31.6011(b)-1 of this chapter (Employment Tax Regulations).

(2) Foreign persons.

The provisions of paragraph (b)(1) of this section regarding the furnishing of one's own number shall apply to the following foreign persons—

(i) A foreign person that has income effectively connected with the conduct of a U.S. trade or business at any time during the taxable year;

(ii) A foreign person that has a U.S. office or place of business or a U.S. fiscal or paying agent at any time during the taxable year;

(iii) A nonresident alien treated as a resident under section 6013(g) or (h);

(iv) A foreign person that makes a return of tax (including income, estate, and gift tax returns), an amended return, or a refund claim under this title but excluding information returns, statements, or documents;

(v) A foreign person that makes an election under § 301.7701–3(c);

(vi) A foreign person that furnishes a withholding certificate described in § 1.1441–1(e)(2) or (3) of this chapter or § 1.1441–5(c)(2)(iv) or (3)(iii) of this chapter to the extent required under § 1.1441–1(e)(4)(vii) of this chapter;

(vii) A foreign person whose taxpayer identifying number is required to be furnished on any return, statement, or other document as required by the income tax regulations under section 897 or 1445. This paragraph (b)(2)(vii) applies as of November 3, 2003; and

(viii) A foreign person that furnishes a withholding certificate described in § 1.1446–1(c)(2) or (3) of this chapter or whose taxpayer identification number is required to be furnished on any return, statement, or other document as required by the income tax regulations under section 1446. This paragraph (b)(2)(viii) shall apply to partnership taxable years beginning after May 18, 2005, or such earlier time as the regulations under §§ 1.1446–1 through 1.1446–5 of this chapter apply by reason of an election under § 1.1446–7 of this chapter.

All of the above requirements to use the SSN for a “foreign person” such as a “nonresident alien” are in connection with the receipt of government property and privileges.

STATUTORY “U.S. Persons”, “citizens of the United States”, and “residents of the United States” are all FULL TIME public officers on official business. This is because EVERYTHING they do on the 1040 form is subject to 26 U.S.C. §162 “trade or business” deductions and because the regulations MANDATE that all “U.S. persons” must use the SSN franchise mark. Statutory “nonresident aliens”, however, are only required to use the SSN/TIN franchise mark when they are engaged in the “trade or business” franchise above or OTHER privileges involving receipt of or beneficial use of government/public property.

5. Types of Numbers

5.1. Tabular comparison of different types of numbers

The federal government uses the following types of identifying numbers:

| Number type | Issuing authority | Issuing agency | Issued to | Instructions | Application form(s) | Notes |

| Social Security Number (SSN) | 20 C.F.R. §422.103 | Social Security Administration | Statutory “U.S. citizens” pursuant to 8 U.S.C. §1401 ; Permanent residents pursuant to 8 U.S.C. §1101(a)(3) | Used to apply for Social security participation. Available only the statutory “U.S. citizens” and permanent residents pursuant to 20 C.F.R. §422.104. | ||

| Taxpayer Identification Number (TIN) | 26 U.S.C. §6109 | Internal Revenue Service | “U.S. persons” pursuant to 26 U.S.C. §7701(a)(30) ONLY. Perjury statement requires you to swear you are a “U.S. person” | Application says to use Form W-8 instead if you are not a “U.S. person”. | ||

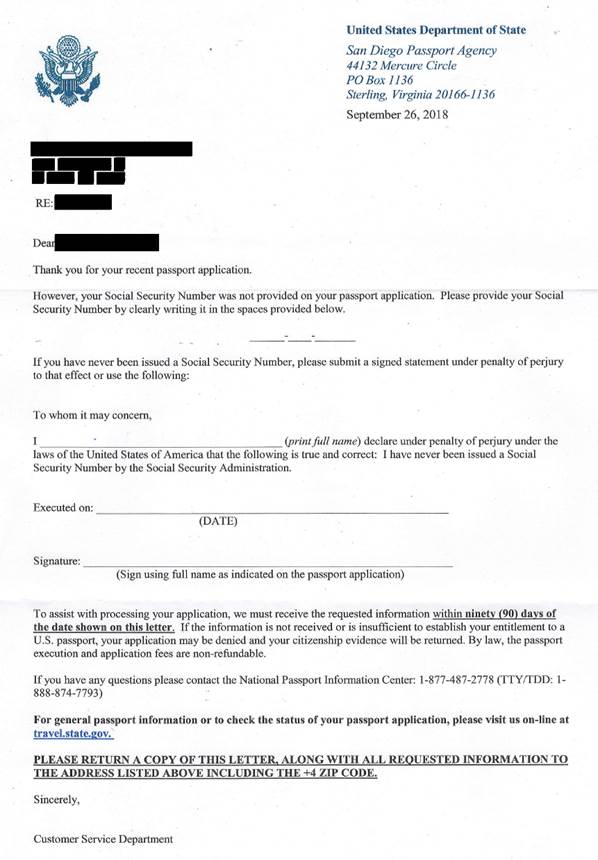

| Individual Taxpayer Identification Number |

26 C.F.R. §301.6109-1(d)(3) |

Internal Revenue Service | Aliens or nonresident aliens who are not “U.S. persons” and are not eligible for Social Security | IRS Publication 1915 : Understanding Your Individual Taxpayer Identification Number (ITIN) |

W-7: Application for IRS Individual Taxpayer Identification Number (TIN) |

An ITIN is a tax processing number, issued by the Internal Revenue Service, for certain resident and nonresident aliens, their spouses, and their dependents. It is a nine-digit number beginning with the number “9”, has a range of numbers from “70” to “88” for the fourth and fifth digits and is formatted like a SSN (i.e. 9XX-7XXXXX).Application must be attached to a valid U.S. return. No tax return will cause application to be rejected. Used in the case of foreign persons who do not qualify for a Social Security Number because not a statutory “U.S. citizen” or permanent resident. |

| Employer Identification Number (EIN) | 26 C.F.R. §301.6109-1(b) | Internal Revenue Service | Businesses who want to engage in federal franchises. | IRS Circular E: Employer's Tax Guide | SS-4: Application for Employer Identification Number | Not eligible for this number if not part of the government. "Employer" defined in 26 U.S.C. §3401(d) as an entity that has "employees". "Employee" is then defined in 5 U.S.C. §2105(a), 26 U.S.C. §3401(c ), and 26 C.F.R. §31.3401(c )-1 as a public officer and not a private employee.. |

5.2. Social Security Numbers

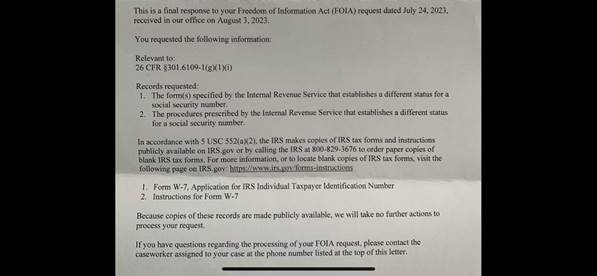

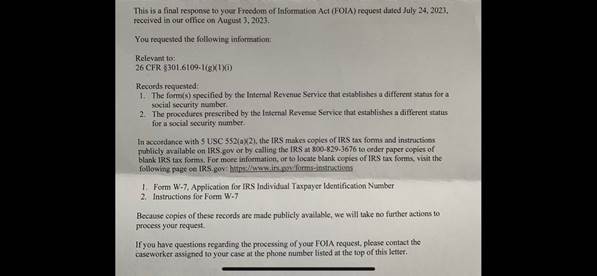

No positive law (OFFSITE LINK) requires anyone to have or use a Social Security Number (SSN). The Social Security Administration admitted exactly this in a letter they sent to us in response to an inquiry about this subject:

All of Title 42 of the U.S. Code (OFFSITE LINK), which has the Social Security code (OFFSITE LINK) embedded within it, for instance, is not positive law (OFFSITE LINK), according to the legislative notes under 1 U.S.C. §204 (OFFSITE LINK), so that even if the code required it, it would not be enforceable against anyone without their individual consent in some form. Neither have we ever seen anyone from the government ever allege that specific sections within Title 42 are positive law either. They are simply optional guidance for the average individual, and not "law" as a consequence. To call Social Security a "law" is to establish a state-sponsored religion in violation of the First Amendment (OFFSITE LINK), in fact. See the following for abundant confirmation of this fact:

- Socialism: The New American Civil Religion, Form #05.016

- Great IRS Hoax, Form #11.302 (OFFSITE LINK), sections 4.3.13 and 5.4 through 5.4.3.6 for an exhaustive analysis and supporting evidence that backs up this conclusion.

5.3. Individual Taxpayer Identification Numbers (ITINs)

Below is the definition of an "Individual Taxpayer Identification Number (ITIN)" (OFFSITE LINK) from the Internal Revenue Code (OFFSITE LINK). Keep in mind that all of Title 26 of the U.S. Code, like Title 42, is NOT positive law and obligates no one to do anything except those who consent to be bound by it by occupying a public office or position of employment within the U.S. government. See Great IRS Hoax (OFFSITE LINK) sections 5.4 through 5.4.3.6 for further details on this:

26 C.F.R. §301.6109-1(d)(3) (OFFSITE LINK)

(3) IRS individual taxpayer identification number --

(i) Definition.

The term IRS individual taxpayer identification number means a taxpayer identifying number issued to an alien individual by the Internal Revenue Service, upon application, for use in connection with filing requirements under this title. The term IRS individual taxpayer identification number does not refer to a social security number or an account number for use in employment for wages. For purposes of this section, the term alien individual means an individual who is not a citizen or national of the United States.

IRS Publication 1915 says that ITINs may be issued to "aliens" or "nonresident aliens", which implies that the term "alien individual" in the regulation above also includes "nonresident alien individuals" as well. HOWEVER, both “aliens” and “nonresident aliens” applying for ITINs MUST be “alien individuals” per the above.

General Information

What is an ITIN?An ITIN is a tax processing number, issued by the Internal Revenue Service, for certain resident and nonresident aliens, their spouses, and their dependents.

It is a nine-digit number beginning with the number “9”, has a range of numbers from “70” to “88” for the fourth and fifth digits and is formatted like a SSN (i.e. 9XX-7XXXXX).

The ITIN is only available to individuals who are required to have a taxpayer identification number for tax purposes but who do not have, and are not eligible to obtain a SSN from the Social Security Administration (SSA). Only individuals who have a valid filing requirement or are filing a tax return to claim a refund of over-withheld tax are eligible to receive an ITIN. Generally a U.S. Federal income tax return must accompany the ITIN application, unless the individual meets one of the “exceptions.” (See “Exceptions”).

Caution: Applications for individuals who are requesting an ITIN as a spouse or a dependent of a primary taxpayer, must attach a valid U.S. Federal income tax return to the Form W-7. ITINs are issued regardless of immigration status because both resident and nonresident aliens may have United States tax return filing and payment responsibilities under the Internal Revenue Code.

[IRS Publication 1915, p. 5, Rev. 9-2007, Catalog Number 22533M;

SOURCE: http://famguardian.org/Subjects/PropertyPrivacy/NumericalID/p1915.pdf]

Consistent with the above, Section 10.4.2 of the following publication points out the IRS habitually and deliberately confuses "aliens" and "nonresident aliens" in the treasury regulations in order to prevent persons born within and domiciled within states of the Union from claiming the "nonresident alien" status. The above confusion is yet one more example of that deliberate confusion:

Non-Resident Non-Person Position, Form #05.020, Section 10.4.2

FORMS PAGE: http://sedm.org/Forms/FormIndex.htm

5.4. What kind of identifying number must Members use when correspondeing with the IRS and for PRIVATE purposes then?

Because ITINs may only be issued to aliens and because members may not be aliens and must be nationals, then Members cannot use or apply for an ITIN. “Nationals”, in fact, are nowhere even listed within the definition of “individual” at 26 C.F.R. §1.1441-1(c)(3) for withholding purposes. “Nationals” are, however, recognized as being able to file a 1040NR, as we point out in:

| Proof that American Nationals are Nonresident Aliens, Form #09.081 https://sedm.org/Forms/09-Procs/ProofAnNRA.pdf |

Consequently, the following restrictions apply to members filing 1040NR returns or corresponding with the IRS in the context of identifying numbers:

- Members may not apply for or use an ITIN because ITINs only apply to “alien individuals” and all Members are “nationals” rather than “aliens”.

- Members are also not eligible to participate in Social Security and therefore cannot use a STATUTORY SSN either. See:

Why You Aren’t Eligible for Social Security, Form #06.001

https://sedm.org/Forms/06-AvoidingFranch/SSNotEligible.pdf - 26 U.S.C. §6109(a)(1) and 26 C.F.R. §301.6109-1(b)(2)(iv) require a foreign person who makes a “return of tax” to use “one’s own number” number, which it refers to as a “taxpayer identifying number”.

- 26 U.S.C. §6109(d) requires that the SSN must be used by those to whom it is LAWFULLY issued. Since Social Security can’t lawfully be offered in the constitutional states, then this provision doesn’t pertain to compliant Members.

- In the ABSENCE of the ability by a Member to use an SSN because not eligible for Social Security or not consenting to participate, and not eligible for an ITIN because not an “alien”, this leaves members wondering exactly what “taxpayer identifying number” they can use. Ironically, 26 U.S.C. §6109 doesn’t answer that question! See for yourself!

26 U.S.C. §6109

https://www.law.cornell.edu/uscode/text/26/6109 - Members still need to be able to maintain a credit history in PRIVATE commerce and therefore will still need to use identifying numbers OUTSIDE the government.

- This leaves members in a quandary about how to function with a STATUTORY number for governmental purposes but a PRIVATE number for PRIVATE purposes.

Our resolution to this dilemma is:

- To describe all numbers provided to the government by Members as NON-STATUTORY numbers issued pursuant to a PRIVATE franchise contract described below, which restrains, prevents, and PUNISHES their use by the government OUTSIDE the government. That agreement is described at:

Injury Defense Franchise and Agreement, Form #06.027

https://sedm.org/Forms/06-AvoidingFranch/InjuryDefenseFranchise.pdf - To say that no statutory terms apply to any of the information supplied on government forms.