|

MASTER FILE (MF) DECODER

|

MF Decoder Pro CD

543 Mbytes;1,273 files

Click here for sample

Click here for sample

History of changes

|

Watch a Demo! (82 minutes, 29 Mbytes). Windows Media Player 9 format

Watch a Demo! (82 minutes, 29 Mbytes). Windows Media Player 9 format

The Master File

(MF) Decoder software is a specialized Microsoft

Access database intended to automate the decoding and analysis

of your IRS electronic records. It:

- Is a law enforcement and self-defense tool

- Provides an important new source of evidence to use

against the government during the administrative and litigation

phases of your tax case.

Click

here for an IMF Decoding training course which explains

the great importance of IMF Decoding

Click

here for an IMF Decoding training course which explains

the great importance of IMF Decoding

- Provides the FOIA forms needed to obtain your IRS electronic

records.

- Produces automated FOIA requests to obtain the records

from the IRS

- Accepts inputs of codes in IRS master file records provided

in response to your Privacy Act requests.

- Flags illegal, fraudulent, or time-barred transactions

that need to be corrected in your record.

- Reports the results of its analysis in an attractive

report that you can send to the IRS in a Privacy Act request

to have added to your IMF file

- Contains a database catalog of all evidence upon which

every determination it makes is based, and each piece of

evidence comes right out of the IRS' own publications and

laws

- Is designed to be shared on a network for use by multiple

users simultaneously

- Can do decodes for multiple users or clients, or used

by professional IMF decoders who have multiple clients.

- Imports data from older versions when you upgrade so

you don't have to reenter your data every time you upgrade

- Algorithms for decoding are constantly being improved

to increase effectiveness.

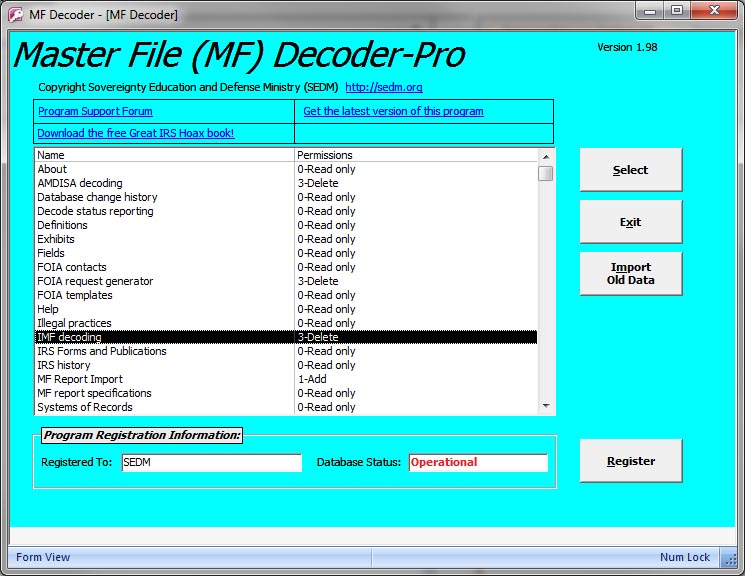

- Comes in two versions:

Professional and

Standard editions

|

|

Attribute |

Professional

Edition |

Standard

Edition |

| MF Decoder Software |

√ |

√ |

MF Decoder

User's Manual (200 pages, PDF format)

User's Manual (200 pages, PDF format) |

√ |

√ |

| MF Decoder Video Tutorial |

√ |

|

|

Professional features

- Automated email decode status reporting using Microsoft

Outlook

- IMF Specific report import (starting with version 1.96)

- IRPTRN report import (starting with version 1.96)

|

√

√

√ |

|

Automated Rebuttal

Letter Template

Produces an automated rebuttal letter with your personal

information entered. Must be customized using the

reports produced by the software. Procedure for using

the automated rebuttal letter found in Chapter 5 of the

latest version of the MF Decoder

User Manual.

|

√ |

|

|

CD-ROM Format

Bootable, browsable CD-ROM (350 Mbytes). Advantages:

- Available to people with slow dial-up lines

- Can be copied to your hard drive and accessed from your

browser at any time

- Content small enough to fit on a USB flashdisk so you

can take it on the road!

- Copy your decoded IMF onto a CD and send the corrected

version, rebuttal letter, and the MF Decoder software in

with your Privacy Act Amendment request to be added to your

administrative record!

Click here to see the

startup browser screen for the Professional version

Click here to see the

startup browser screen for the Professional version

|

√ |

|

|

Exhibit Catalog

Complete exhibit library proving the meaning of nearly every

field or process or transaction decoded by the MF Decoder software:

- Browsable PDF files with scanned images of IRS documents

showing the meaning of each field or transaction or illegal

technique

- Tied to Exhibits form within MF Decoder software

- Each exhibit is catalogued and organized for ready reference

during court litigation against the IRS

|

√ |

|

|

IMF Decoding Manual

Library

Complete electronic library of IRS IMF decoding manuals in

PDF format. Each manual has a navigation pane on the left

consisting of the complete table of contents for easy navigation

throughout the document. Includes the following publications:

- IRS Document

6209, 2003 Edition (665 pages)

- IRS Document

6209, 1998 Edition (622 pages)

- IRS Document

6209, 1997 Edition (317 pages)

- IRS Document

6209, 1976 Edition (97 pages)

- IRS Document

11734, Rev. 12-2001: Transaction Codes Pocket Guide

-

Substitute For

Returns Program Handbook MT5480-4, dated 02-06-91

(130 pages)

-

Substitute For

Returns Program Handbook MT5480-7, dated 09-04-93

(246 pages)

-

Service Center

Collection Branch Procedures MT5000-34, dated

03-27-89 (200 pages)

- AIMS Processing

Handbook, dated 02-08-99 (91 pages)

- IRS Law Enforcement

manual (LEM) III, 3(27)(68), LEM III-386, dated 01-01-90

(292 pages)

- Individual

Master File (IMF) Operations Manual, 3(55)(0), MT 3000-353,

dated 01-01-96 (37 pages)

- Business Master

File (BMF) Operations Manual, 3(52)0, MT 3000-346,

dated 01-01-95 (27 pages)

- Automated Non

Master File (ANMF), 3(17)(46), MT 3(17)00-271, dated

01-01-96 (216 pages)

- Transcripts

Manual, 3(65)0, MT 35-00-219, dated 01-01-96 (168

pages)

- IRS Federal

Tax Lien Handbook, dated 02-02-2000 (42 pages)

- IRS Collection

Manager's Handbook, dated 02-2000 (90 pages)

- Department

of Justice Criminal Tax Manual, dated 05-28-1998

(1298 pages)

- Federal Rules

of Evidence, last updated 05-12-2003 (181 pages)

|

√ |

|

|

Freedom of Information

Act and Privacy Act Documents Library

Complete electronic library of Freedom of Information Act

and Privacy Act Reference Documents, including:

- Freedom of Information Act, 5 U.S.C. 552 (link)

- Privacy Act, 5 U.S.C. 552a (link)

- Internal Revenue

Service (IRS), Systems of Records, Federal Register

Vol. 66, pp. 66784-63875 (93 pages)

- Internal Revenue

Service (IRS), Systems of Records, Internal Revenue

Manual Exhibit [1.3] 15-2 dated 08-19-98 (13 pages)

- Dept. of the

Treasury, Systems of Records, Federal Register Vol.

66, pp. 44205 thru 44213 (10 pages)

- Citizens Guide

to Using the Freedom of Information Act and the Privacy

Act (74 pages)

- IRS Disclosure

Litigation Reference Book, dated 4-2000 (314 pages)

|

√ |

|

|

IMF Decoding Training

Curriculum

IMF decoding and tax training materials:

- IMF Decoding presentation by SEDM (40 slides)

- Richard Standring's audio IMF training (MP3 audio)

- Great IRS Hoax: Why We Don't Owe Income Tax (latest

edition)

- Assumption of Liability book (latest edition)

- How to Keep 100% of Your Earnings movie (1.5 hours)

|

√ |

|

|

Anti-Propaganda

Materials

Rebutted versions of the government's two most popular propaganda

publications:

- IRS "The Truth about Frivolous Arguments"

- Congressional Research Service report 97-59A: "Frequently

Asked Questions Concerning the Federal Income Tax"

|

√ |

|

Complete user manual available for FREE

as follows:

|

Download Free

MF Decoder User Manual

Version 1.76 (3.31 Mbytes, Last updated 11-30-09)

(Right-click and select "Save-As" to save to your local

hard drive)

|

You can obtain the software by clicking on one of the two options

below. This website is the ONLY outlet for this software.

If you obtained this software any other way, you were SCAMMED and we

want to hear about WHO scammed you. Please submit a message

through our

Contact Us Page identifying

the scamster so we can black list him/her/it:

|

Get

MF Decoder (MFD) PROFESSIONAL

Version 1.99

(Shipped as CD,

Last updated 7-24-15)

|

Get

MF Decoder (MFD) STANDARD

Version 1.99

(27 Mbytes download,

Last updated 7-24-15)

|

Click here

for a detailed history of changes since the first release of this software

Click here to read what people are saying about this software

- Compatible Operating Systems: Windows 2000,

Windows XP, Windows Vista, Windows 7, or Windows

Server 2003 or 2008

-

Microsoft Access 2000, 2003, 2007,

2010, 2013, or Office365 installed-mandatory.

Microsoft Access is part of

Microsoft Office Professional.

NOTE:

Microsoft Access 97 or earlier WILL NOT work so

please don't contact us to complain about this fact

or ask us to help you to get it to work.

-

Personal

Computer or compatible.

- Note:

Does not work on the Macintosh except in

Windows Emulation mode with Microsoft Access installed. Microsoft Access is NOT available under MacOSX so it will only run within the emulated virtual machine.

- 128MB RAM.

- 60 MB available disk space.

If you do not have the time to obtain,

learn, and use this software because you are under the gun and have

a restrictive time schedule or if you would rather have a professional

obtain and decode your Individual Master File (IMF), SEDM offers full-service

IMF decoding based on the Master File Decoder software. Your decoded

IMF is delivered to you in CD-ROM format for the period of years you

specified. The CD also contains a full version of the Master File

Decoder Professional software that you can use in the future to do your

own IMF decode or to update the decoded data provided by SEDM.

Click here for more information about full-service, professional

IMF Decoding Services offered by the Sovereignty Education and Defense

Ministry (SEDM).

- Visit our Support area, Section 7

for answers to frequently asked questions and video tutorials demonstrating

how to do selected tasks with this software.

- Visit our

MF Decoder

Support Forums, Forum #5.1 to view questions and answers relating to use

of the software by our

Members.

Note that you MUST register to access this forum and that you must

consent unconditionally to our

Member Agreement

in order to register.

- Click here for a video demo of the

software. 68 Minutes. Requires Microsoft Media Player 9.

-

Click here for a video tutorial on how to enter IMF data on

the IMF Decoding Screen. 81 Minutes. Requires Microsoft

Media Player 9.

- For more information about why we had to write this software,

click here.

- You can obtain more information about how to decode your IMF

from

step 0.8 of the

Sovereignty Forms and Instructions, Form #10.004.

- You can use this software to automatically generate your FOIA

requests. Alternatively, you can do it manually by

clicking here if you don't have the software.

- If you don't want to use or can't use the MF Decoder software,

you can also have your file decoded professionally by

clicking here.

- To get your questions answered about how to decode your master

file, consult other users at our

Member Forums, but please

read the user manual for the software first so you don't burden

people with needless questions. You must consent unconditionally

to our Member

Agreement in order to join our support forums.

- To report bugs or problems with this software, use the

MF Decoder

Support Forums, Forum #5.1. Please read the user manual first before

you submit a bug report, because your problem may be operator error

and we don't want to clutter the forum with frivolous questions.

- The software is large (28 Mbytes) and requires Winzip (http://www.winzip.com)

to unzip once downloaded.

- Please follow the instructions starting in section 2.2 of the

free user manual to install the software

after you download and unzip it.

free user manual to install the software

after you download and unzip it.

- The software includes activation for one user and one computer. We do not allow members to split the cost and install on multiple computers.

- This is the tool

that the IRS is most afraid of because it puts their

fraud right in front of your face and explains every minute detail

of it using their own laws and publications so you can prove it

yourself in court and in front of a jury! The government

is going to crap their pants when they see this thing working folks!

- Low in cost.

We want to bust up the IRS monopoly and racketeering ring on a massive

scale and subject individual IRS agents to personal criminal liability

for their violations of IRS laws and procedures in the illegal collection

of income taxes. This software along with the

Great IRS Hoax book are a very important part of doing that.

- Very easy to use.

Designed for the layman with few computer skills. We want

EVERYONE to be getting copies of their IMF under the Freedom of

Information Act, and especially those who are in hot water with

the IRS!

- Developed using input from and beta tested by the best minds

in the IRS decoding business and the top three decoding companies,

including the following and more we can't list:

- http://www.imfdecoder.com

in Tacoma, Washington.

- http://www.tpirsrelief.com/.

- My many very talented and dedicated readers and users, who

have sent and continue to send valuable feedback based on their

extensive experience obtaining and decoding their own Individual

Master File.

- No other software

like it is offered ANYWHERE. One of only two softwares

of its kind available to the general public and the the

best software.

Several companies offer IMF decoding services, some charging as

much as $10,000! This software will save you MEGABUCKS folks!

- Based on the content of the IRS' own publications, references,

and laws, including:

- Comes with a short

MF Decoder

User Manual in Acrobat format showing in detail how

to install and operate it.

MF Decoder

User Manual in Acrobat format showing in detail how

to install and operate it.

- Certified virus

and copy protection and spyware free. No adds or

banners to harass you and the software doesn't snoop on you or reveal

your private information to third parties or force you to give up

your privacy to register it.

- Detailed reports

showing the meaning of each field or term and the authorities from

which the meaning was derived. This makes the reports useful

as legal evidence in court.

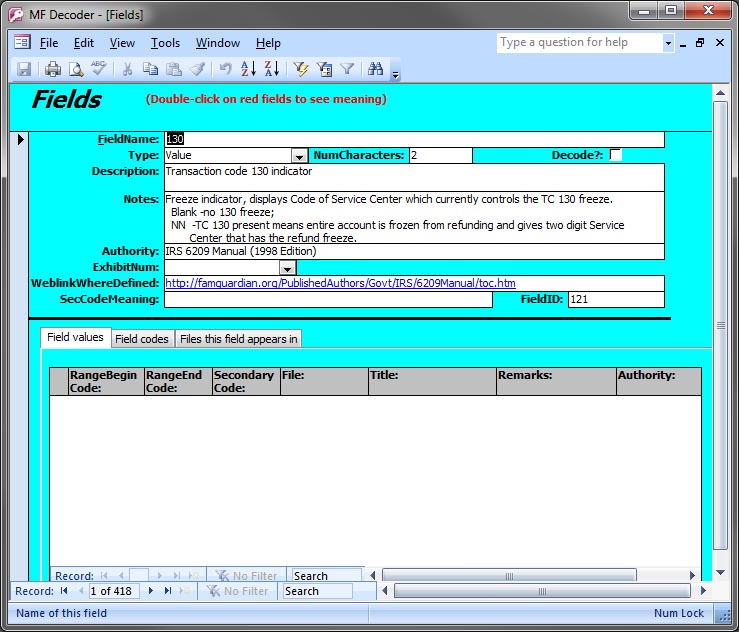

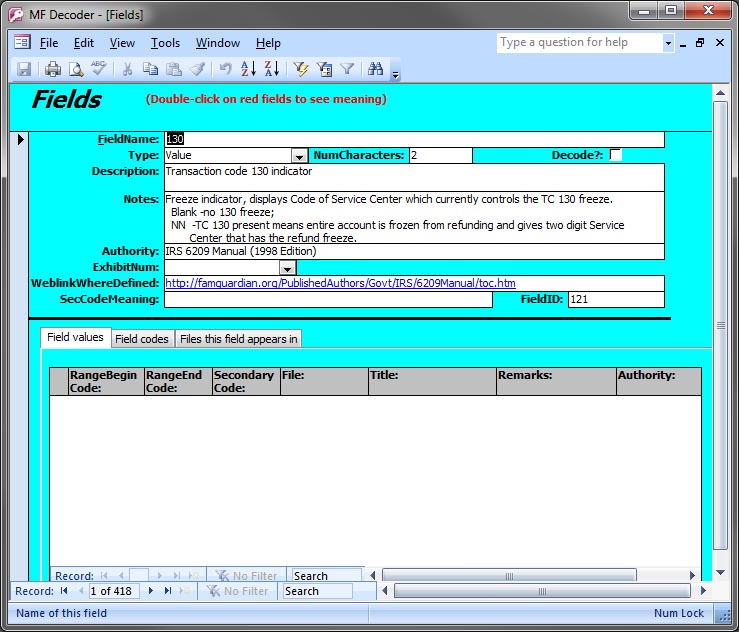

- Help on each field by simply double-clicking on it to see detailed

background.

- Integrated online

help system

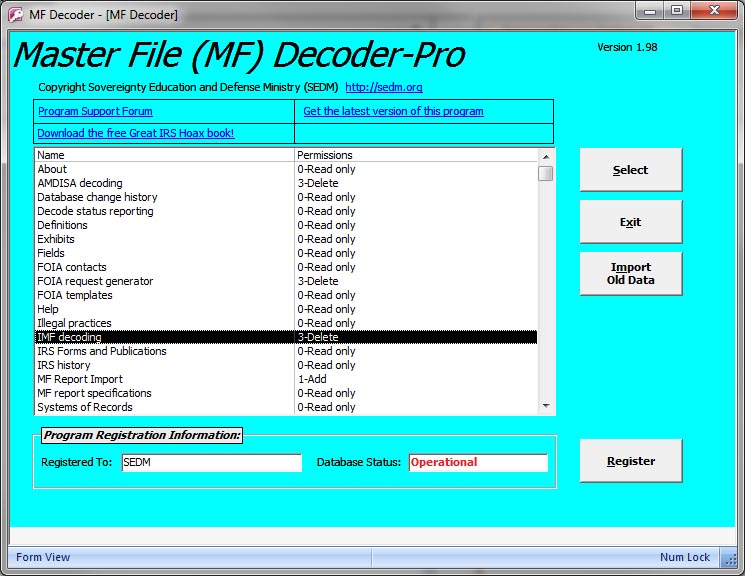

- User screens for:

- Definitions of

IRS terms and acronyms. Approx. 700 terms

and definitions so far. Each definition shows the IRS

publication that it was derived from.

- Decode status reporting:

Allows automated decode status emails to be sent out to all

active clients if you are decoding professionally.

- Fields listing

for Individual Master File (IMF), Business Master File (BMF),

and Employee Plans Master File (EPMF) records.

240 fields so far with complete listing of field values and

meanings and the authorities from which they are derived.

- IRS forms and publications.

Complete database of all IRS forms and publications. 740

IRS forms listed so far.

- Systems of records.

Records available from the Treasury and IRS through the Freedom

of Information Act and Privacy Act.

- User accounts.

Allows IMF's of multiple users to be decoded. Great for

businesses that are servicing multiple "nontaxpayers" who have

been defrauded by the IRS.

- Exhibits.

Lists all exhibits that form the basis for the interpretation

of every field and transaction decoded by the software.

- FOIA contacts.

All offices where you can send your FOIA requests. Maintained

up to date.

- FOIA templates.

Predefined FOIA requests that can be automatically customized

and generated for each user. 13 so far. Please send

us others.

- FOIA request generator.

Automatically fills in a FOIA template with the information

specific to a person and prints it out with all exhibits ready

for mailing.

- AMDISA decoding.

Decodes your IRS audit information.

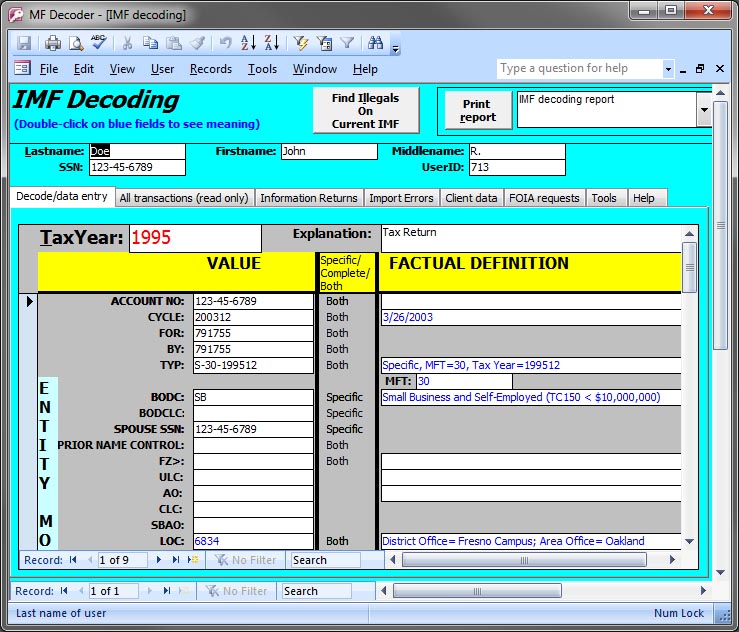

- Individual Master

File (IMF) decoding. Deciphers all codes in your

IRS files regarding the returns that you have filed or which

were filed by the IRS in you behalf.

- IRS History.

Documents the chronological history of the Internal Revenue

Service (IRS).

- Illegal practices:

Various illegal techniques used by unscrupulous IRS agents for

falsifying your IRS electronic record. 5 illegal practices

so far.

- Database change

history. History of revisions to the database design.

- Transaction codes.

Identifies all transaction codes that are used in the transaction

portion of your IMF and BMF file.

- Flags in red all IMF records that are suspected of being illegal

or fraudulent, tells you why they are illegal, and tells you what

to ask for to get further evidence of illegal activity. Illegal

activity detection includes (but is not limited to):

- Suspicious freezes on account, putting it in manual mode.

- Illegal Substitute for Returns (SFRs) (from TXMOD transactions

report).

- Invalid blocking codes, which indicates an illegal manipulation

of the IMF.

- Illegal Transaction Code 370 importations from NMF and BMF.

- Time-barred assessments outside the Assessment Statute Expiration

Date (ASED).

- Illegal extension of Assessment Statute Expiration Date

(ASED) by lying to the computer that you submitted an IRS form

872.

- Time-barred collection activity outside the Collection Statute

Expiration Date (CSED).

- Illegal notices sent to "taxpayer", such as CP-501, CP-502,

CP-503, CP-504.

- Automatically looks up most codes contained in the IMF file

and explains what they mean.

- Source for definitions

of all terms and fields is clearly shown so you can verify the information

yourself. This makes the software outputs useful

in a court of law when litigating against the IRS and the DOJ.

We even give you a web hotlink for the definition or field so you

can look it up online automatically!

- Sample "IMF MCC-SPECIFIC" reports from the IRS included with

highlighted fields showing what each definition means.

- Complete error-handling with copious feedback if you make a

mistake.

- Prints completed FOIA requests appropriate for your situation,

so you don't have to worry about the minutia.

Conditions on the copyright for those who use the software:

A very important

goal of this software is to democratize the FOIA and IMF discovery process

so that anyone

can do it with very little expertise. This will hopefully reduce

the cost of getting it done if you decide to pay someone to do it.

Because of this, we insist that all companies that are decoding IMF's

for clients using this software MUST:

-

Tell their clients

that they are using this software.

-

Tell them where

on the internet they can download their own version of the software

and offer a place to download it if this website is not accessible.

That way, everyone

who is paying for decoding of their IMF will know what they are paying

for and can investigate learning to use the tool themselves. Likewise,

every private individual who uses this software is required to tell

at least three others about it, including the web address where they

can download it.

Users agree not

to resell, reverse engineer, modify, rename, or redistribute a renamed

software without the express written consent of SEDM.

Click here to see a sample report.

Click here to see a sample report.

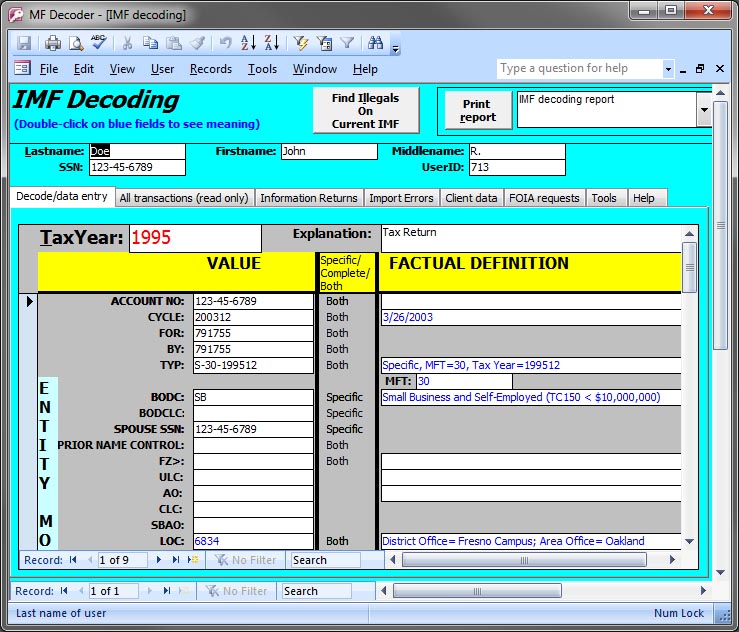

Below are some screen shots from the software:

We welcome your suggestions for enhancing the software. In

particular, we invite you to submit the following:

- The meaning of codes in IMF, BMF, or EPMF files that are not

currently decoded by the software and the reference document (e.g.

Internal Revenue Manual

or

6209 Manual) which describes the meaning of the code.

-

Documentation of new illegal practices

you have discovered that are not already identified by the software.

Please accompany the documentation of your new fraud technique with

an actual scanned image of an IMF file and the IRS manual showing

how the technique is used and a detailed explanation of why you

think it is a bogus transaction, including references to the

Internal Revenue Manual

or

6209 Manual section that explains your analysis.

Click here for a revision history for

the software. This information is most useful to those who obtained earlier versions of the software and who want to see what new features have been introduced since them so that they will know whether they should upgrade.

MF Decoder is provided

without warranty of any kind. Users agree to use the software

at their own risk and to hold the developer harmless and not

liable for any and all consequences arising from using or lack

of ability to use the software. It is not intended or authorized

to be used as a "tax

shelter" or way to reduce the

lawfully assessed liability of a "taxpayer"

|

|