SEDM FEDERAL RESPONSE LETTER INSTRUCTIONS

1. Introduction

|

IMPORTANT!:

|

2. Preparing your Computer and Obtaining Software to Use Our Letters

Every SEDM Response Letter comes as a ZIP file containing one or more separation Microsoft Word (*.doc) and Adobe Acrobat (*.pdf) files. In order to use our response letters, you will therefore need:

- A computer.

- Basic computer skills, such as ability to login to your computer, use the browser.

- A web browser to view and download files. The following two

browsers are our favorite because they support tabbed browsing

that allows you to open and use multiple windows simultaneously.

3.1 Microsoft Edge.

3.2 Google Chrome3.3 Mozilla Firefox

3.4 Vivaldi - A ZIP Decompression utility to extract files from the Zip so they can be used. See the following article on our website:

- Microsoft Word 2000 or Office 2000 or later installed. See:

- Free

Adobe Reader or

Adobe

Acrobat Standard or

Acrobat Professional

installed. It is best if you have Adobe Acrobat Standard or Professional,

because:

6.1 Adobe Reader does not allow you to save a PDF form in such a way that the data you entered into the form is preserved for later reuse.

6.2 Adobe Acrobat Standard or Acrobat Professional both support saving of filled in forms to preserve the data that is entered for later reuse.

Why do we use the ZIP file format to package our letters? Below are a few reasons:

- They compress the files so they are smaller and therefore quicker and easier to download.

- They allow multiple files to be associated together into one simple file for easy handling and downloading.

- Our ministry bookstore software electronic download function only allows us to dispense one file electronically at a time, and therefore we chose a ZIP file.

3. What do do if you don't receive the order confirmation email immediately after you place your order

Immediately after you place your order for a response letter, you should receive an order confirmation email in your email inbox. If you don't receive the order confirmation email, the following scenarios are likely and should be investigated before you call or contact us to ask for us to resend the order confirmation email:

- You are using Microsoft Outlook and the order confirmation was placed in your "Junk E-mail" folder.

- Your Internet Service Provider (ISP) placed our domain name or server IP address in his bulk email filter list, causing the order confirmation email to be placed in the "Junk mail" or "Bulk mail" or "Spam" queue on their server.

- You are using a spam filter such as Spamarrest (http://spamarrest.com) to supplement the offerings of your Internet Service Provider and they placed the order confirmation email in their "Unverified" folder.

For all of the above scenarios, the solution to the problem is to use the following procedure:

- If you are using Outlook, check your "Junk E-mail" folder and see if the order confirmation email is in there. If it is, right click on the email in the folder, select "Junk E-mail" in the properties menu, and then select "Add sender to Safe senders list".

- Next, login to your spam filter provider such as Spamarrest through their web interface. Examine the "Unverified" folder for the order confirmation email. If it is there, check in the checkbox and click the "Authorize" button to add us to your "safe senders" list.

- Next, login to your Internet Service Provider web interface and look in your "Spam" or "Bulk mail" folder for the order confirmation email. Yahoo mail (http://yahoo.com), for instance, has a "Spam" folder. When you find the order confirmation email, remove it from the Spam filter list.

It is very common that people do step 1 above but forget the other two steps and call us to complain that they never received the email. Please make sure that you execute ALL THREE of the above steps so that every place where spam filtering is accomplished has been examined BEFORE you call us to ask for help. Many people aren't even aware of the spam filtering that is done by their spam filtering service provider or their ISP and have never even logged into the web interface for these providers. This happens usually because they didn't setup their computer themself and the person who set it up for them never told them how the email works. It is important for you to understand this because otherwise, you will create lots of needless extra work for us trying to figure out how your email system works or in resending the order confirmation to an alternate address that is unfiltered. PLEASE BE A GOOD AND RESPONSIBLE NETWORK CITIZEN by learning how your system does spam filtering so that you can ensure that you will get emails that people send you when you want them.

4. Downloading Your Response Letter from the SEDM Website and Extracting the files from the ZIP

Please make sure you use Microsoft Internet Explorer and turn OFF your firewall software before you start the download. If you are using Netscape or AOL browsers, or you forget to turn off your firewall software, the download will probably not work. Be advised that the download link in the Order Confirmation Email will work for exactly 48 hours and then expire so please take action before then or you will create needless extra work for us manually recreating the expired link. You may call our technical support to get help with download problems at 800-753-7661. Also be advised that it is a violation of the Member Agreement (see http://sedm.org/participate/member-agreement/) and the copyright to share your copy with anyone outside of your immediate family or to resell it. Downloads are monitored and you will be contacted if you exceed your download limit. We do not advise reusing this letter again if you get another similar letter in the future because our response letters are updated frequently and may not work in the future.

To download your response letter, follow the procedures below:

- Order the response letter from our Ministry Bookstore.

- After you complete the ordering process, you will receive an Order

Confirmation Email containing instructions and a download link similar

to the following:

An online order was just processed on the Sovereignty Education and Defense Ministry (SEDM) web site. Below is the information for the order.

Order Number: ORD200709114

Date: 09/11/2007

Time: 23:18:32

IP Address: 77.77.77.77

Referring URL: Not Applicable

Account ID: Not Applicable

Affiliate Code: Not Applicable

Status: Completed

Payment Method: [redacted]

Item Subtotal: Canadian $65.00

Total Amount: Canadian $65.00

Billing Information:John Doe

11201 Elm Street

Anytown, Anystate 77777

United States

Telephone Number: 777-777-7777

Fax Number: Not Applicable

Email Address: johndoe@confidential.com

===========================================================

Item: Federal Form 4549 Response - Canadian $65.00

Quantity: 1

http://www.sedm.org/storepublic/downloads/51F1621418-IRS-FRM4549.zip

Username: softgood

Password: downloadit

Thank you for obtaining the Federal Form 4549 Income Tax Examination Changes Response letter. We very much appreciate your donation and welcome you to visit us again. Thank you also for becoming a Member of SEDM, which the checkout process repeatedly emphasized is mandatory in order to obtain any of our strictly educational information or materials. As a Member, you consent unconditionally to abide by all present and future versions of the Member Agreement, which you may read at: http://sedm.org/participate/member-agreement/ The text above this paragraph contains a link to our website where you may download your copy of the letter in ZIP format. Just click on the link, enter the Username and Password appearing above, and you will be then asked where you want to save the file. Select the location on your local hard drive and then hit OK. Allow plenty of time to finish the download. Don’t forget to download and install a ZIP decompression utility in order to uncompress the file after you download. Information about decompression utilities is available at: http://sedm.org/DecompressionUtility.htm.

Please make sure you use Microsoft Internet Explorer and turn OFF your firewall software before you start the download. If you are using Netscape or AOL browsers, or you forget to turn off your firewall software, the download will probably not work. Be advised that the download link in this email will work for exactly 48 hours and then expire so please take action before then or you will create needless extra work for us manually recreating the expired link. You may call our technical support to get help with download problems at 800-753-7661. Also be advised that it is a violation of the Member Agreement (see http://sedm.org/participate/member-agreement/) and the copyright to share your copy with anyone outside of your immediate family or to resell it. Downloads are monitored and you will be contacted if you exceed your download limit. We do not advise reusing this letter again if you get another similar letter in the future because our response letters are updated frequently and may not work in the future.

If you have problems with the content of the letter that are related to simple matters of Previewing, Printing, spelling or grammar, then you may contact our tech support at 800-753-7661. If you have any other questions or problems with the letter, please write down your questions and fax them with your contact information to (800) 753-7661. You will subsequently be contacted via email or phone with an answer to your questions.

BEFORE contacting us about problems with your response letter, please ensure that you:

1. Carefully read and follow the RESPONSE LETTER INSTRUCTIONS at the beginning of the letter.

2. If this does not address all your issues, next visit our Support page, Section 3 entitled "Tax Response Letter Help" and try the online tutorials there. These two tutorials deal with 95 % of the problems that people call us about. You can view the Support page at the link below:

- You must initiate the download from the email above by one of two

methods:

3.1 Simply clicking on the link, if your email program is connected with your browser. The link is:

http://www.sedm.org/storepublic/downloads/51F1621418-IRS-FRM4549.zip

3.2 If the email program is not interfaced with your browser such that clicking on the above link doesn't work, you must:

3.2.1 Selecting the link text in your email program by clicking at the beginning, holding down the left mouse button, and dragging it to the end of the link text.

3.2.2 Copy the link text by pressing "Ctrl-C" on your keyboard.

3.2.3 Open the browser window separately using the START button on your screen.

3.2.4 Click in the browser Address Bar.

3.2.5 Paste the link text into the browser address bar by pressing "Ctrl-V".

- Next, you will see a login screen asking for a username and password.

Enter the following information and click "OK":

Username: softgood

Password: downloadit -

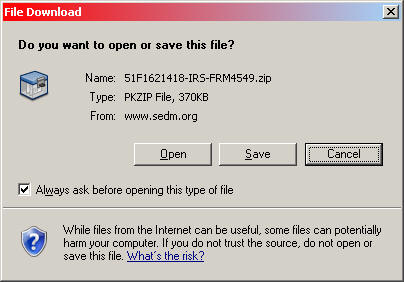

Next, you will see the following screen appear:

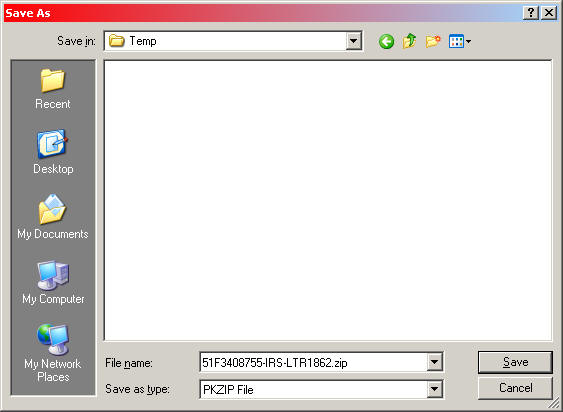

- The "Save As" dialog will now appear.

- Locate the directory where you want to save the file and click the "Save" button in the above dialog box.

- To extract the files from the ZIP file you just downloaded, follow

our article below:

Using Decompression Utilities

5. Preparing Your Response Letter

The general procedure for preparing your response letter is as follows:

- The response letter comes as a file with a ".doc" extension on the end of the name. If you are viewing the files from Windows Explorer, this file extension may be hidden from view.

- First, you will need to follow the instructions on the first page

of the letter, which require that you enable Microsoft Word to Enable

Macros:

2.1 Microsoft Word 2003 and earlier:

2.1.1 Select "Tools->Macro->Security…" in the Microsoft Word menus. The security dialog box will appear.

2.1.2 Click on the “Security” tab and then select the “Low” radio button.

2.1.3 Then click on “OK”. Then close and restart Microsoft Word and reopen the document for the changes to take affect.

If you have trouble with the above three steps, visit Section 3.3 on our Support Page for further guidance.

2.2 Microsoft Word 2007 and later:

Follow the graphical procedures in Section 3.5 of our Support Page.

- After you have set Microsoft Word Macro Security level to Low, open

the file with Microsoft Word:

3.1 Select "File"

3.2 Select "Open"

3.3 Locate the file.

3.4 Click the "Open Button"

-

Navigate to the Response Letter Worksheet within the letter using the scroll bars on the left. Below is an example of the Worksheet

# Field description Format/

ExampleValue 1 First name Upper and lower case 2 Middle name Upper and lower case 3 Last name Upper and lower case 4 Street address 5 City 6 State Spell out

(NO two-letter designators)7 Zip code (NNNNN-NNNN) 8 Home Phone (NNN) NNN-NNNN 9 Social Security Number NNN-NN-NNNN 10 Date of original IRS notice MM/DD/YYYY 11 Date of this letter MM/DD/YYYY 12 IRS Service Center Address Street address 13 IRS Service Center City 14 IRS Service Center State AA 15 IRS Service Center Zip code NNNNN-NNNN 16 IRS Service Center Contact (from IRS letter) John Doe 17 IRS Service Center Employee ID (from IRS letter) 18 Tax Year(s) in Question YYYY or

YYYY-YYYYNOTES: - Do not write any part of your name in all capital letters.

- MM=two character month

- DD=two character day

- YYYY=four character year

- N=a numeric digit

- A=an alphabetic character

- Fill in the Response Letter Worksheet above with all the information requested.

- Click the "Preview" button below the worksheet to fill in the letter with the information from the worksheet.

- If you are satisfied with the result, click the "Print" button below the worksheet to print the letter.

6. Downloading and Printing the Response Letter Exhibits

Most response letters require either exhibits or forms or both. The Response Letter Exhibits originate from one of two locations, both of which are accessible at the top of the Opening Page of the SEDM Website:

- SEDM Forms Page. This is where all the forms come from for the response letter exhibits. For example, if the Response Letter says "Form #05.001", that means form number 05.001 on this page.

- SEDM Exhibits Page. This is where all the evidence Exhibits come from. For example, if the Response Letter says "EX1024", that means Exhibit number 1024 on this page.

After you have printed your response letter, you should download all the Forms and Exhibits listed at the beginning of the Response Letter itself. Below is an example list of Exhibits from the Federal 4549 response letter example above:

Exhibits:

1.Original IRS 4549 Letter you sent

2.Legislative Intent of the 16th Amendment, Congressional Record US Senate [EX0029]

3.Department of the Treasury Organizational Chart published in the Federal Register [EX0031]

4.1 CFR 601.702(a)(1) Requirement for implementing regulations [EX0019]

5.1 CFR 301.6109-1 Identifying Numbers [EX0004]

6.Cynthia Mills Letter , IRS Disclosure Officer Hoverale Letter [EX1000]

7.Michael L. White, Federal Attorney, Office of the Federal Register GAO letter 9-15-2003 – IRS without statutory authority to impose penalty to enforce compliance [EX0021]

In the above list, "[EX0029]" within Exhibit 1 above means Exhibit 0029 on the SEDM Exhibits Page above.

IMPORTANT:

The SEDM Member Agreement,

Section 2.3, requires that all response letters

must

include corrected information returns, even if they are not listed

in the Response Letter Exhibits list at the beginning of the letter.

You must prepare one corrected information return for

every type

of information return filed against you for the years that are the

subject of the collection letter you receive in accordance with

the following references:

If your response letter does not include an exhibit section for corrected information returns, we recommend that Item #6 above be included with the corrected information return and provided attached to your response letter. Generally, IRS form W-2C is used to correct false IRS form W-2's. You should only use standard IRS form 4852's if you are filing a return. Otherwise, the form W-2C must be used to correct false IRS form W-2's. In addition, we recommend that every one of the response letters you send in should have the following completed forms attached to clearly establish your status with legally admissible evidence, even if these forms do not appear in the Response Letter Exhibits list at the beginning of the letter. All of the following forms are electronically fillable to simply the task of "voluntary compliance" [heee....heeee]:

For the purposes of satisfying the repetitive requirements of this note, we suggest preparing all the forms to satisfy the requirements of this section and then reusing them for all your response letters. In order to reuse forms you have prepared, you may either:

The reason for mentioning the above two options is that the Free Adobe Acrobat Reader does NOT allow you to save and reuse forms you have filled in electronically and you will need to buy the Standard or Professional versions of Adobe Acrobat for a few hundred dollars in order to have this capability. |

7. Mailing Your Response

Generally, we advise:

-

Keeping the original of all documents and mailing copies. The original of the document is more readily admissible than a copy in a court of law, which is why you keep it.

-

Mailing a copy (NOT the original) of the the

Certificate/Proof/Affidavit

of Service, Form #01.002 with each copy. This will

put the recipient on notice that he is now legally accountable for responding.

Certificate/Proof/Affidavit

of Service, Form #01.002 with each copy. This will

put the recipient on notice that he is now legally accountable for responding.

A very important way to ensure that the people at the receiving end are held accountable for responding is to develop court admissible evidence of what you sent, when it was sent, and to whom it was sent. The options for this are as follows, where the lowest number is the most preferred:

- Use our

Certificate/Proof/Affidavit

of Service, Form #01.002 with the instructions contained with the

form. This provides immediately admissible evidence of a notary

which proves:

Certificate/Proof/Affidavit

of Service, Form #01.002 with the instructions contained with the

form. This provides immediately admissible evidence of a notary

which proves:

1.1 What was sent.

1.2 When it was sent.

1.3 By whom it was sent.

The only disadvantage of this approach is that it costs usually about $15 to do each time: $10 for the notary plus $5 for the mail server whose identity was verified by the notary.

- Send the letter Certified Mail with return receipt. This approach has the major problem that there is no independent evidence of WHAT was sent, which means you must provide foundation testimony in a court before there is evidence of WHAT was sent.

- Send the letter with no proof of sending or deliver by simply dropping it in the mail. This should be avoided at all costs because it leaves you in a very vulnerable position.

If you would like to know more about how to develop a good administrative record, see "Techniques for Building a Good Administrative Record, Form #09.008".

Most tax collection notices are sent out by a computer unsigned without a personal contact at the agency who sent them. This does nothing but encourage irresponsibility and injustice on the part of the agency. If you send your response letter ONLY to the address indicated on the computer notice, then most of the time, it will be ignored because it does not name a specific "belly button" who has to take responsibility. You are much more likely to achieve positive and consistent results if you send your letter to several places in addition to the return address indicated on the notice. The higher up the food chain you go in the federal workplace, the more likely you are to get results. One technique we like to employ is to include in the list of addressees some very high level supervisors. IRS supervisors do not like to be cc'd on everything that is sent to the subordinates. They don't like getting floods of correspondence from you any more than you like being flooded with collection notices from the IRS. You can use this technique to become a "squeaky wheel" that gets plenty of grease and attention. IRS knows this, and so they don't publish a personnel listing of people at the service centers and national offices. You must really dig for this information. Below is a list of the sources for IRS agency personnel listings that you can use to find addresses of supervisors to send your response letters to, sequenced in descending order of value:

-

Congressional Quarterly Staff Directory (OFFSITE LINK)

Congressional Quarterly Staff Directory (OFFSITE LINK)

- Family Guardian: Important Contacts Page (OFFSITE LINK)

- IRS contacts page (OFFSITE LINK)

-

U.S. Government Manual (OFFSITE LINK)

U.S. Government Manual (OFFSITE LINK)

8. Follow-Up

The squeaky wheel gets the grease! This means the more hassle and trouble you make for the government every time they bother you with a collection notice, the less likely they are to bother you. The following techniques are helpful in this regard:

- Repeated calls to the IRS commissioner, the managers of collection, the attorney general of your state, etc.

- Filing criminal complaints against those who filed the false information returns.

- Repeatedly filing corrected information returns to ensure that the false information about you is removed from their records.

The contacts at the end of the previous section are a good starting point to locate high-level people who you should bother constantly to ensure that they feel just as bothered about violating the law as you feel bothered about receiving their notices to begin with.

9. Getting Copies of Assessment Documents

If you received a Notice of Deficiency or Notice of Proposed Assessment (NPA) collection letter, it is important in your response to request legally admissible evidence of a lawful assessment using the Freedom of Information Act, the Privacy Act, and their equivalent at the state level. One procedure for doing this is as follows:

- Download the Demand for Verified Evidence of Lawful Assessment form

from our Forms page:

1.1. Download and complete the

Demand for Verified Evidence of Lawful State Assessment, Form #07.204

if you are responding to a State notice.

Demand for Verified Evidence of Lawful State Assessment, Form #07.204

if you are responding to a State notice.1.2 Download and complete the

Demand for Verified Evidence of Lawful Federal Assessment, Form #07.304

if you are responding to a Federal notice.

Demand for Verified Evidence of Lawful Federal Assessment, Form #07.304

if you are responding to a Federal notice. - Complete a cover letter that includes a FOIA request and attach

it to one of the two forms above, demanding legal the information indicated

in the attached Demand for Verified Evidence. A good example of

such a letter is the following form:

IRS Freedom of Information Act Request, Form #03.014

- If the request is for a federal collection action, send the request to a FOIA service center listed on the Important Government Contacts Page (OFFSITE LINK), at the end under Internal Revenue Service. There you will find a listing of IRS Disclosure Offices that are their to respond to FOIA requests.

- If your request is for a state response letter, send it to the entity who mailed you the collection letter or go to the State Legal Resources page (OFFSITE LINK) to find the place to send it.

10. Tips on managing your administrative record

Your administrative record consists of all correspondence going both directions between you and the government. Maintaining a good administrative record is of utmost importance as a defense against illegal collection actions. Over the years, we have discovered a number of tips useful in managing and minimizing the size of your administrative tax record. Below is a summary:

- Respond to EVERY tax collection you receive and cc as many people as you can. This is called "earnest letter writing".

- In every correspondence you send them, include the following language

where possible:

I look forward to being corrected promptly in anything you believe is inconsistent with reality found in this correspondence or any of its attachments. If you do not respond, I shall conclude that you believe I am a “nontaxpayer” who is neither subject to nor liable for any internal revenue tax.

"The revenue laws are a code or system in regulation of tax assessment and collection. They relate to taxpayers, and not to nontaxpayers. The latter are without their scope. No procedure is prescribed for nontaxpayers, and no attempt is made to annul any of their rights and remedies in due course of law. With them Congress does not assume to deal, and they are neither of the subject nor of the object of the revenue laws..."

"The distinction between persons and things within the scope of the revenue laws and those without is vital."

[Long v. Rasmussen, 281 F. 236, 238(1922)]I remind you that your own IRS mission statement says that you can only help “taxpayers” to understand their tax responsibilities and therefore, if you won’t talk with me, the only thing I can logically conclude is that I must not be a “taxpayer” and instead am a “nontaxpayer” not subject to any provision within the I.R.C. In that case, thank you for confirming that I am person outside your jurisdiction and not “liable” for any internal revenue tax:

IRM 1.1.1.1 (02-26-1999)

IRS Mission and Basic OrganizationThe IRS Mission: Provide America’s taxpayers top quality service by helping them understand and meet their tax responsibilities and by applying the tax law with integrity and fairness to all.

- Some of the response letters can be large. In order to reduce

the size of your administrative file, it is helpful to:

3.1 Keep all but the signature page of the originals in electronic form so that they don't clutter your files and records.

3.2 Print on double-sided paper.

- The only thing we normally keep are the originals of the Certificate of Service and the signature pages of each correspondence. The remainder of the correspondence we send out is kept in electronic form on our computer and backed up regularly. If we need the whole document at any point, we simply print it out and append the signature original signature pages that we sent out.

- It is important to maintain proof that you sent the response letter

and what it contains. This is accomplished by using our

Certificate/Proof/Affidavit

of Service, Form #01.002. A Certified Mail return receipt

does not prove EXACTLY WHAT was sent, but only that SOMETHING was sent,

nor is it authenticated by a disinterested third party or notarized.

This makes its value as legal evidence inferior to the

Certificate/Proof/Affidavit

of Service, Form #01.002. A Certified Mail return receipt

does not prove EXACTLY WHAT was sent, but only that SOMETHING was sent,

nor is it authenticated by a disinterested third party or notarized.

This makes its value as legal evidence inferior to the

Certificate/Proof/Affidavit

of Service, Form #01.002 and opens the possibility that the judge

will exclude it from evidence in litigation.

Certificate/Proof/Affidavit

of Service, Form #01.002 and opens the possibility that the judge

will exclude it from evidence in litigation. - If you attach exhibits to your correspondence, you should label

each exhibit with the phrase below at the bottom of the page:

"Exhibit ___ of ____: Not valid without all exhibits attached."

If litigation ever ensues involving liabilities documented in your administrative record, a favorite trick of the government is to conveniently "lose" portions of your correspondence in their records that are incriminating or which they don't want to deal with. This is their way to filter evidence. Judges do the same thing by ordering selected portions of your administrative record excluded from evidence and review by the jury. By labeling each exhibit and adding the phrase above, you alert the jury that the judge or the IRS or both are obstructing justice by hiding the full content of the administrative record from the jury.

For further information on how to maintain a good administrative file, see:

Techniques for Building a Good Administrative Record, Form #09.008

11. Authorized uses of Response Letters

Please carefully note that none of the authorized purposes of our response letters are commercial. Our response letters are not authorized or intended to be used as a "tax shelter" or as a way to reduce the liability of a "taxpayer". In fact, they are prohibited from being used by "taxpayers" so as to prevent them from being used to interfere with the lawful enforcement of the I.R.C. Rather, our response letters are primarily law enforcement and self-defense tools exclusively for use by "nontaxpayers". We emphasize that every man has an inalienable right to learn and know and use the law in his own self-defense, and also has a right to assistance of counsel in learning and knowing and using the law in his defense by obtaining and reading our educational materials.

A Response Letter is a letter that you prepare in order to send to the government in response to an income tax collection notice which was sent to you wrongfully or illegally. It was sent wrongfully or illegally usually because of one of the following situations pertaining to the "nontaxpayers" (ONLY!) who use this website:

- The collection action is based upon information returns such as the IRS form W-2, 1042S, 1098, and 1099 contained erroneous or false information because of mistake or ignorance on the part of the sender.

- Your private employer compelled you to complete and submit an IRS

form W-4 under threat of either not being hired or being fired.

This represents:

2.1 Slavery in violation of the Thirteenth Amendment, 42 U.S.C. §1994, and 18 U.S.C. §1589

2.2 Criminal racketeering in violation of 18 U.S.C. §1951

2.3 Makes all information returns files based on it into inadmissible fruit of a crime excludible under the "fruit of a poisonous tree doctrine".

2.4 Makes those who withhold the taxes associated into money launderers for the U.S. government in violation of 18 U.S.C. §1956

- The collection action was against a nonresident party not domiciled

on federal territory and therefore not a "taxpayer". This is the

case with everyone who maintains a domicile within any state of the

Union on other than federal territory who is therefore a "nonresident

alien". See:

3.1

Non-Resident

Non-Person Position, Form #05.020

Non-Resident

Non-Person Position, Form #05.0203.2

Federal Enforcement

Authority in States of the Union, Form #05.032

Federal Enforcement

Authority in States of the Union, Form #05.032 -

You were illegally compelled to use a Social Security Number that was not yours in order to simply work or live in violation of 42 U.S.C. §408.

Click here

for details.

Click here

for details. - You made a mistake in the paperwork you sent to the government and fixed it, but they self-servingly refuse to correct it in their records.

- The IRS or state revenue agency did an unlawful assessment upon

you in violation of the Internal Revenue Code, Treasury Regulations,

or the Internal Revenue Manual. See:

SEDM Response Letters are only available for use by Members who agree unconditionally with the terms of our Member Agreement and satisfy all of its provisions for all tax years in which they intend to employ our information or services. This ensures that we are never accused of interfering with any LAWFUL government function or tax. The Member Agreement specifically requires that:

- Members must quit Social Security by sending in the following form:

Resignation

of Compelled Social Security Trustee, Form #06.002

Resignation

of Compelled Social Security Trustee, Form #06.002 - Members must correct the citizenship records of the government and

politically disassociate their domicile from the government using the

following form:

Legal Notice of Change

in Domicile/Citizenship Records and Divorce From the United States,

Form #10.001

Legal Notice of Change

in Domicile/Citizenship Records and Divorce From the United States,

Form #10.001 - Members must consistently and regularly rebut all information returns filed against them in response to every tax collection notice they receive in order to preserve their good standing and prevent becoming party to any government franchises. See Section 7 later for details on how.

- Members may not use a Social Security Number or Taxpayer Identification

Number on any government form, and must consistently state that they

are not eligible for any federal benefit and include a copy of SSA-521

form showing their resignation from the program with the number removed

so they aren't connected with it. See Section 2 and the following:

About SSNs and TINs on Government Forms and Correspondence, Form #07.004

If you aren't complying with the above steps, then you are abusing our materials and using them in a highly unauthorized manner for which you agree to assume full, exclusive, and personal responsibility.

12. Frequently Asked Questions About Responding to tax collection notices

Our readers frequently ask us questions about how to respond to various situations relating to response letters. Below are some of the more common questions:

Question 1: I do not see any information on the steps to take next if they ignore a response I sent them. If they keep "rubber stamping" their decisions, I still end up in collection. The question is what is the place to read the next step. Your paperwork in very good, but need I to follow through.

Answer #1: Don't fall into the trap that we have all the answers. There must be some room for you to use your own creativity. All we know is what the law says, how to explain what it says, and what it obligates the government to do. What you are asking about is how to deal with an essentially political problem within the agency that is supposed to respond, which is whether or how they choose to respond to the correspondence.

In our experience, the higher up you go with your response and the more cc parties you have on your response, such as the commissioner and the chief counsel, and the more proof of service you use, the more accountable they will be and act and the more likely you are to get the results you seek.

What we do in our case is keep our whole administrative record in electronic form on a single DVD, and also make it available online, and then attach a copy of the disk to every correspondence and give a link to the online version to build up our administrative file so we have standing to sue for a false claim. We also send it to the very high ups, and we more often than not get a cessation of hostilities. If you only respond to "ACS" or some flunky at the bottom without cc'ing everyone else, then you will get undesirable results. Personal accountability on the part of the recipient, and naming specific people is the best way to get results. Telephone follow up can also help quite a bit. If the notice you receive doesn't have the name of a specific person, then single out at least one person high up on the food chain for personal accountability and hound them relentlessly on the telephone and via mail. You may wish to resend the response with a one page cover letter to the commissioner and the IRS chief counsel and tell them they will be called as witnesses. This gets them squirming and causes them to discontinue the notices. Click here (OFFSITE LINK) for a list of contacts you can use for this purpose.

13. Further reading and research

- Support Page, Section 3: Tax Response Letter Help

- Frequently Asked Questions About Our Response Letters

- Index of Federal Tax Notice and Letter Responses

- IRS Forms and Publications: AMENDED (OFFSITE LINK)-Family Guardian

- IRS Forms and Publications: THEIRS

- Writing Effective Response Letters, Form #09.006

- Techniques for Building a Good Administrative Record, Form #09.008

- Handling and Getting A Due Process Hearing, Form #09.005

-

Presumption: Chief Means

for Unlawfully Enlarging Federal Jurisdiction, Form #05.017- IMPORTANT!

SEDM Forms

Presumption: Chief Means

for Unlawfully Enlarging Federal Jurisdiction, Form #05.017- IMPORTANT!

SEDM Forms - Legal Research Sources (OFFSITE LINK)-exhaustive research sources on law and taxation

- Tax Fraud Prevention Manual, Form #06.007-chapter 3 describes how to respond to federal and state tax collection notices. You should only read this manual after you have read chapters 3 through 5 of the Great IRS Hoax.

- Liberty University-free training on law, sovereignty, and taxation

-

Flawed Tax Arguments

to Avoid, Form #08.004-rebuttals to common tax arguments you are

likely to hear from the government, the legal profession, and freedom

advocates

Flawed Tax Arguments

to Avoid, Form #08.004-rebuttals to common tax arguments you are

likely to hear from the government, the legal profession, and freedom

advocates -

Rebutted Version

of IRS' "The Truth About

Frivolous Tax Arguments", Form #08.005 -arguments you

are likely to hear by IRS against some of the information on this website

Rebutted Version

of IRS' "The Truth About

Frivolous Tax Arguments", Form #08.005 -arguments you

are likely to hear by IRS against some of the information on this website -

Rebutted Version

of Congressional Research Service Report 97-59A: Frequently Asked Questions

About the Federal Income Tax, Form #08.006-rebutted version of some

of the more common court arguments you are likely to hear

Rebutted Version

of Congressional Research Service Report 97-59A: Frequently Asked Questions

About the Federal Income Tax, Form #08.006-rebutted version of some

of the more common court arguments you are likely to hear - Rebutted Version of Dan Evan's "Tax Resister FAQs", Form #08.007 (OFFSITE LINK)- Family Guardian

- Tax Deposition Questions, Form #03.016 (OFFSITE LINK)-questions/admissions you can use in your response letters

- Great IRS Hoax, Form #11.302 (OFFSITE LINK)

| Copyright Sovereignty Education and Defense Ministry (SEDM) |

| Home About Contact |