Frequently Asked Questions (FAQ)

ABOUT RESPONSE LETTERS

1. What is a response letter?

A response letter is an automated form letter that is sent to either the federal or a state revenue collection agency in response to a specific usually automated notice, letter, or form that is received from that organization. It acts as both a criminal complaint against unlawful acts and a political "Petition for Redress of Grievances" protected by the First Amendment to the United States Constitution. The extent of the Constitutional protections for this right are thoroughly documented below:

Statement of Facts and Beliefs Regarding The Right to Petition the Government for a Redress of Grievances-by We the People Foundation for Constitutional Education

The purpose of a response letter is to:

- Act as a criminal complaint against those

filing

false information returns.

filing

false information returns. - Submit an administrative request to correct the

filing

false information returns.

filing

false information returns.

- Help you exercise your right under the

First Amendment to Petition your government for a redress of illegal

or unconstitutional enforcement activities on its part. The wrongs

in this case, include but are not limited to:

3.1 Illegal and unlawful collection actions.

3.2 Illegal government activities outside its territorial jurisdiction.

3.3 Involuntary servitude in violation of the Thirteenth Amendment, 42 U.S.C. §1994, and 18 U.S.C. §1589.

3.4 Deprivation of Constitutional rights under color of law in violation of 18 U.S.C. §242.

3.5 Conspiracy against rights in violation of 18 U.S.C. §241.

3.6 Treason in violation of 18 U.S.C. §2381.

3.7 Compelled association with the government or "taxpayers" in violation of the First Amendment.

3.8 Taking of property without due process of law.

3.9 Identity theft and kidnapping, by moving a person's "res" or identity to the District of Columbia under 26 U.S.C. §7701(a)(39).

3.10 Falsification of government records (IMF).NOTE: Those who are statutory "

taxpayers" may not complain of any of the above. The

only way you can become a statutory "

taxpayers" may not complain of any of the above. The

only way you can become a statutory " taxpayer"

is with your consent and it is a maxim of law that anything you

consent to cannot form the basis for an injury cognizable in a

de jure court of law. Only those who are "nontaxpayers"

can be and are protected by the Constitution and therefore may

complain of an injury to rights protected by the Constitution.

See:

taxpayer"

is with your consent and it is a maxim of law that anything you

consent to cannot form the basis for an injury cognizable in a

de jure court of law. Only those who are "nontaxpayers"

can be and are protected by the Constitution and therefore may

complain of an injury to rights protected by the Constitution.

See:

Why Domicile and Becoming

a "Taxpayer" Require Your Consent, Form 05.002

Why Domicile and Becoming

a "Taxpayer" Require Your Consent, Form 05.002 - Provide a starting point for you to write your own equivalent response letter/petition for redress.

- Save you significant time and effort researching the laws on taxation.

- Minimize your legal risk exposure and the possibility of IRS penalties.

- Establish your

citizenship status as

other than that which might confer jurisdiction upon them.

Click here for details.

citizenship status as

other than that which might confer jurisdiction upon them.

Click here for details. - Generate exculpatory evidence documenting your

domicile as being

outside of the territorial jurisdiction of the agency or government

who sent you the notice.

Click here for a revealing

article on this subject.

domicile as being

outside of the territorial jurisdiction of the agency or government

who sent you the notice.

Click here for a revealing

article on this subject. - Disassociate you with any false reports of "

trade or business"

earnings. Click here

for details.

trade or business"

earnings. Click here

for details. - Shift the burden of proof to the agency attempting the illegal enforcement under the Administrative Procedures Act, 5 U.S.C. §556(d) and 26 U.S.C. §7491. Click here for an article on the subject of government burden of proof.

- Challenge and rebut any false

presumptions the agency

is making and establish that these presumptions violate your

due process rights.

Click here for a revealing

article on this subject.

presumptions the agency

is making and establish that these presumptions violate your

due process rights.

Click here for a revealing

article on this subject. - Generate exculpatory evidence documenting your status as a "nontaxpayer". Click here for details.

- Demand evidence of a legal duty to pay the tax and a "liability" in the law. Click here (OFFSITE LINK) for an article on this subject.

- Fill your administrative record with exculpatory evidence and law that immunizes you against further criminal or civil legal action on the part of the government directed against you. This will help you document your basis for reasonable belief that you have no legal liability, and thereby deflect and prevent the government from being able to prove that you willfully and maliciously evaded a known legal duty. All tax crimes have willfulness as a prerequisite. Click here for an article on this subject.

- Estop the agency from further

illegal enforcement actions by establishing

facts based on their silence in responding. This is exactly the

same approach they use against you to manufacture "taxpayers".

Fight fire with fire!

Click here for an article

on how this works.

Click here for an article

on how this works. - Educate the revenue agents who are illegally attempting collection or enforcement activity against you so that they don't repeat their misbehavior.

- Demonstrate to the agency that you know

your rights

and will stick up for them, both administratively and legally.

your rights

and will stick up for them, both administratively and legally.

|

NOTE: The purpose of a response letter is NOT to reduce your tax liability or violate any law, but to lawfully assert and defend your constitutional rights. Our response letters are only available to those who are "nontaxpayers", which are persons not subject to any internal revenue tax, and who consent unconditionally to our SEDM Member Agreement, Form #01.001. Since our items are not available to "taxpayers", then it is impossible to describe them as "tax shelters" or to reduce the liability of anyone who might obtain them. None of the materials available on this website are authorized to be used to accomplish any commercial result that might subject us to government regulation. |

2. How does the response letter ordering and use process work?

The response letter ordering process works as follows:

- Go to the one of the following response letter index pages, depending

on the notice you received:

State Response Letter Index, Form #07.201

Federal Response Letter Index, Form #07.301

- On one of the Response Letter Index Pages above, find the response letter that matches the one you received by examining the PDF samples provided.

- Click on the "Get response letter" blue link to the right of the response letter sample provided on the index page.

- Add the response letter to your shopping cart.

- Complete the Ministry Bookstore checkout process.

- After you have completed the bookstore checkout process, you should receive an Order Confirmation Email in your email inbox. That email will contain a download link on the web along with instructions for downloading the response letter, which is a compressed *.ZIP file.

- After you have followed the download instructions in the Order Confirmation Email, next you extract the files contained in side the compressed *.ZIP file onto your local hard drive. That process is described here.

- Next, open Microsoft Word, and set the Macro Security Level to LOW

as directed below:

in step 1 of the INSTRUCTIONS sheet at the beginning of the letter. See the directions below on how to do this:

8.1 Microsoft Word 2003 and earlier: SEDM Support Page, Section 3.38.2 Microsoft Word 2007 and later: SEDM Support Page, Section 3.4

- Exit Microsoft Word completely and start it back up in order for the Macro Security Level changes to take effect.

- Next, open the response letter, which is a Microsoft Word *.DOC file using your Microsoft Word word processor.

- In the response letter, fill in the Response Letter Worksheet with your personal information.

- Click on the "Preview" button below the worksheet to see what your finished response letter will look like.

- If you are happy with the result, click on the "Print" button below the Response Letter Worksheet to print the letter.

- Go to the web addresses directed in the letter and download the Exhibits to attach to the letter. Most exhibits can be found in our Exhibits Page.

- Print out all exhibits and attach to the letter.

- Mail the letter.

If you would like further specific details on how to use the automated response letters, see the following two links:

3. What is included with your response letters?

Our response letters are distributed as a compressed ZIP file containing one or more of the following:

- Response Letter Template File: Contains the response letter file in Microsoft Word for Windows format. Microsoft Word for Windows is available as a separate application from Microsoft and is also distributed as a standard part of their Microsoft Office product. This template file is automated with a macro so that all you have to do is fill out a simple form about your situation and then hit "Preview" to see the finished letter. After you are satisfied with the results, simply hit the "Print" button. No skills in using Microsoft Word are necessary in order to use the Response Letter Template.

- Exhibit File: An Adobe Acrobat file containing any exhibits or attachments that must be attached to the letter. This file may be read using the free Acrobat Reader provided by Adobe Systems. Most of these exhibits are extracted from our Exhibit Catalog.

- Forms and Samples: An Adobe Acrobat file contains forms that you will need to fill out and attach to your response letter along with a sample of each form so you know how the form is best completed. Most of these forms are extracted from here.

Each response comes with a cover sheet that provides complete and detailed instructions intended to show you exactly how to use the response letter. The decision of whether to use it or how to use it is entirely your choice.

4. What requirements does my computer have to meet in order to be able to use your response letters?

The computer requirements are as follows:

- IBM compatible Personal Computer

- Windows 95, 98, 2000, Windows XP, or Windows Vista installed

-

Microsoft Word 97 or later or Microsoft Office 97 or later.

Note that NONE of the following alternatives can successfully edit our

response letters:

3.1 Microsoft Wordpad, which comes with Windows.

3.2 Microsoft Works.

3.3 Open Office

3.4 Microsoft Word for the MAC unless in Intel mode.

3.5 Word Perfect.

- Adobe Acrobat Reader version 5.0 or later installed (free download)

NOTE: Our response letters use Microsoft Visual BASIC macros. Since Visual BASIC is ONLY supported on the PC, then the letters will NOT work on a MACINTOSH computer. Sorry about that! The number of MAC users is so small that we just can't justify the massive expense and time needed to support it. If you are one of the unfortunate few who have this problem, may we suggest that you borrow a friend's PC or use a public library PC to assemble the response letter.

5. What do your response letters look like and can you show me a sample?

Below are two completed samples of a fictitious response letter for an Federal CP-14 notice:

-

Federal

CP-14 Response Letter in Microsoft Word format

Federal

CP-14 Response Letter in Microsoft Word format -

Federal CP-14 Response

Letter in Adobe Acrobat format

Federal CP-14 Response

Letter in Adobe Acrobat format

6. How can I get help on my response letter if I have problems?

No word processing or computer skills are required in order to download and complete your response letter. We have tried very hard to make the process of preparing a personalized response letter as simple as possible in order to save you time. However, if you have problems using the template letters or find an error, you are encouraged to pursue the following course of action in the sequence presented:

- Refer to our Support Page, Section 3 for help with 95% of the most frequent questions and problems you are likely to encounter.

- If the above doesn't work, call our technical support below in order to either get the erroneous letter fixed or to help you complete the letter. Note that our technical support can help you use the template and tell you the appropriate information that might go into any fields dealing with Federal contacts. Everything else is up to you. Also, our technical support staff has no legal training and cannot provide legal advice of any kind to anyone who calls:

SEDM Technical Support

Email: Contact Us page, or http://sedm.org/about/contact/

7. Do you guarantee any kind of result with your response letters?

An important central theme of this website is PERSONAL RESPONSIBILITY and the SELF OWNERSHIP that responsiblity enables. You can't OWN yourself unless and until you agree to take complete, exclusive, and personal responsibility for all of your actions and choices and to not offload any part of that responsiblity to any third party, and espcially not us. What you are asking for in essence is to pay us money to offload or avoid that responsibility, which means you don't really want EDUCATION, but INSURANCE. We don't sell insurance for any amount of money and we aren't an insurance company.

Unfortunately, we are not able to guarantee any particular result if you decide to either use or send in a response letter that we provide. The reasons are many, but we will summarize a few below:

- The letters are provided for educational use. Any other use is at your discretion.

- The letters represent what we would do for ourself in a similar situation and do not constitute legal advice about what you should do. Our Terms of Use and Service, Form #01.016, Section 4 prohibit the giving of legal advice.

- We have tried very hard to ensure that every aspect of the letters is in complete compliance with the statutes, regulations, and internal agency procedures. However, most government taxing agency employees either don't know the law or choose to deliberately disregard it. Under such circumstances, there is no way we can predict how the specific government agency employee who is processing your paperwork will respond. We are not mind readers.

- No matter how much we might want to guarantee our letters or other offerings, if we promised anything, the government might try to slander or accuse or illegally prosecute us for violations of 26 U.S.C. §6700, abusive "tax shelters", even though we are outside of their territorial and subject matter jurisdiction (see this article) and do not have any federal employment, contracts, or agency which might otherwise bestow subject matter jurisdiction under Fed.Rule.Civ.Proc. Rule 17(b). They would falsely try to claim that we are offering a "tax shelter" or promising to reduce the taxes of "taxpayers", even though our Member Agreement, Form #01.001 says that "taxpayers" aren't allowed to use this site or obtain our materials through a donation to our ministry. The government might risk trying this kind of corrupt and vexatious legal harassment in violation of 18 U.S.C. §1589(3) because they quite frankly don't want you knowing the truth about their tax scam or seeing you equipped with the knowledge or tools you need to defend your Constitutional rights.

Consequently, you will have to use our materials with a healthy

dose of discretion and back their use up with your own research and beliefs.

Consistent with Section 9 of our

Member Agreement, Form #01.001

and the free memorandum of law entitled

![]() Reasonable Belief About Tax

Liability, Form #05.007, those beliefs may not derive from anything

we say on this website or communicate personally to you or give to you,

but ONLY from three very specific and exclusive sources:

Reasonable Belief About Tax

Liability, Form #05.007, those beliefs may not derive from anything

we say on this website or communicate personally to you or give to you,

but ONLY from three very specific and exclusive sources:

- The Constitution of the United States of America

- The Statutes at Large published after January 2, 1939.

- The rulings of the U.S. Supreme Court and not lower courts.

There are plenty of free materials in which to base your own research on at:

- Family Guardian Website, Taxation Page (OFFSITE LINK).

- SEDM Liberty University

Our

Member Agreement, Form #01.001

requires that you may not

send in our materials to the government if you think you are a "taxpayer"

(as defined in

26 U.S.C. §7701(a)(14)), "U.S.

citizen" (as defined in

8 U.S.C. §1401), "U.S.

resident" (as defined in

26 U.S.C. §7701(b)(1)(A)), "U.S.

persons" (as defined in

26 U.S.C. §7701(a)(30)) or a person with any federal office, federal

employment, federal agency, or federal contacts. We can't determine

whether you are or aren't any of these because we can't make legal determinations

about your status under our Member Agreement, Form #01.001.

![]() Click here for the

reason why. Only you, as the sovereign can decide that for yourself,

and if you force us to decide it, we would be "practicing law" without a

license. We can truthfully say that after many years of diligent study

of state and federal law, we have been unable to find any law that made

us subject to the I.R.C.

Click here for the

reason why. Only you, as the sovereign can decide that for yourself,

and if you force us to decide it, we would be "practicing law" without a

license. We can truthfully say that after many years of diligent study

of state and federal law, we have been unable to find any law that made

us subject to the I.R.C.

All that our ![]() SEDM Articles of Mission, Form

#01.004 allow us to do is educate but not personally or individually

help people (but not businesses) who have decided based on their own research

and belief that they are "nontaxpayers" who are NOT subject to any part

of

Subtitle A of the Internal Revenue Code (OFFSITE LINK). If you

want to be free you MUST learn the law for yourself and follow it carefully:

SEDM Articles of Mission, Form

#01.004 allow us to do is educate but not personally or individually

help people (but not businesses) who have decided based on their own research

and belief that they are "nontaxpayers" who are NOT subject to any part

of

Subtitle A of the Internal Revenue Code (OFFSITE LINK). If you

want to be free you MUST learn the law for yourself and follow it carefully:

“One who turns his ear from hearing the law [God's law or man's law], even his prayer is an abomination.”

[Prov. 28:9, Bible, NKJV]"But this crowd that does not know [and quote and follow and use] the law is accursed.”

[John 7:42, Bible, NKJV]"Salvation is far from the wicked, For they do not seek Your [God's] statutes [laws and commandments]."

[Psalm 119:155, Bible, NKJV]"Every man is supposed to know [AND FOLLOW] the law. A party who makes a contract with an officer [of the government] without having it reduced to writing is knowingly accessory to a violation of duty on his part. Such a party aids in the violation of the law."

[Clark v. United States, 95 U.S. 539 (1877)]

For more quotes like the above, see:

Authorities on why we must PERSONALLY learn, follow, and enforce man’s law and God’s law

8. Why would I want to make a donation for response letters when I can just write my own?

It takes a lot of very painstaking legal research to develop a response to a notice or letter or form you might receive from a government taxing agency. If you are a busy person and especially if you are an entrepreneur who has a business to run, then you may not have time to do the kind of in-depth legal research that our materials are famous for. Over time, we expect that you will if you follow the requirements to be a Member, but if you are just starting off and need a little help, then we are there to lend a hand while you are getting on your feet and educating yourself so you don't make the kinds of painful mistakes when you are beginning that can get you in trouble.

Conversely, if you don't intend to ever educate yourself, then we don't want you using our materials at all and advise you to just pay the government whatever they ask for and bend over. Slavery is the inevitable result of laziness and ignorance and we don't want your inevitable and eventual failures to denigrate our reputation and credibility.

"The

hand of the diligent will rule, But the lazy man will be put to forced labor.

"

[Prov.

12:24, Bible, NKJV]

"Desperate

and ignorant people will inevitably screw up any good legal argument."

[Anonymous]

“My

people are destroyed for lack of knowledge.”

[Hosea

4:6, Bible, NKJV]

Consequently, you might be able to benefit from the research of others and speed up the learning process by using our materials as a starting point to write your own response letter. Or you might decide to just use what we provide without modification. The decision is up to you as the Sovereign. You own your life and your money and your time and only you have the authority to decide how you want to spend them. Remember that you can't be "dependent" and "sovereign" at the same time. We aren't here as a substitute for "big brother" and we don't want you to use us as a permanent "crutch" . If you do, then you will bring reproach upon us and injure yourself. Only knowledge and faith can set you free. No amount of money or assistance from others can provide that to you if you are unwilling to invest the time and effort to develop these things in yourself. We don't want you worshiping our expertise or any man or lawyer for that matter. That would be idolatry. Instead, we want you to get educated and motivated so you can be completely sovereign over your own life, property, and liberty without having to depend on any "man" to do that. You will never get to that point if you can't trust God and your own reading of the law for yourself and continue to believe the lie that only a lawyer or a judge or expert can do that for you. To admit that is to admit that you are a SLAVE to someone else.

If you have taken the time to do your legal homework as our Member Agreement, Form #01.001 requires and have dedicated yourself to educating you and your family about their rights under the law, then you may have come to the point where you feel you are competent to write your own letter entirely on your own. To that we can only say: "Bravo!". However, we also don't want you calling us to get free help in writing your own letter. That would amount to theft of our time and we can't sanction or condone that. The workman is worthy of his hire and ought to be treated justly and equitably. There are exceptions to this rule on a case by case basis based on exceptional need, however. We are just not equipped or resourced adequately to provide individualized help to the hundreds of thousands of people who read and use this website. Please respect our time, turn off the STUPID boob tube, and start diligently investing in your own faith, education and enlightenment by reading the materials on this website and the Holy word of God. Your body is what eat, and your mind will become what you feed it. You will find after only a year of learning and homework, that your whole outlook on life will be completely transformed and you will become an entirely new person!

"And do not be conformed to this world, but be transformed by the renewing of your mind, that you may prove what is that good and acceptable and perfect will of God." [Romans 12:2, Bible, NKJV]

Liberty is NOT a spectator sport. Now roll up your sleeves and get to work! The man who believes he can be free without taking personal responsibility for educating himself is a FOOL!

"When your terror comes like a storm,

And your destruction comes like a whirlwind,

When distress and anguish come upon you.

Then they will call on me, but I will not answer;

They will seek me diligently, but they will not find me.

Because they hated knowledge

And did not choose the fear of the LORD,

They would have none of my counsel

And despised my every rebuke.

Therefore they shall eat the fruit of their own way,

And be filled to the full with their own fancies.

For the turning away of the simple will slay them,

And the complacency of fools will destroy them;

But whoever listens to me [God and His Word] will dwell safely,

And will be secure, without fear of evil.”

[Prov. 1:27-33, Bible, NKJV]

9. Can I or should I reuse an old response letter template that I got from your website before?

Our response letters are frequently updated based on our collective experiences. The legal and especially the tax fields are very dynamic and constant innovation is required to ensure the best possible results. Consequently, we do not recommend reusing a response letter template you may have obtained before because it may no longer be consistent with the prevailing statutes or regulations at the time that you use it. Laws change frequently and therefore our letters and procedures must change with them to be current, relevant, and effective. Every time you need a response letter, you should obtain the latest version from our website.

10. May I share or sell the response letters I obtain from SEDM?

Our response letters are copyrighted and may not be duplicated, sold, or shared with anyone other than the person who directly obtained it from our website. Doing otherwise is a violation of the Member Agreement, Form #01.001 and the Copyright Notice and will subject you to civil liability.

11. Who is the audience for your response letters?

Our response letters are intended ONLY for those who satisfy the following criteria described in our About Us page, section 15:

- "nontaxpayers"

- "

nonresident aliens"

but not "individuals"

nonresident aliens"

but not "individuals" - Not a "citizen" or "resident" under federal law, which is a person

domiciled on federal territory.

Click here

for details.

Click here

for details. - Not engaged in a "

trade or business"

trade or business"

- Domiciled in states of the Union and outside of the "federal zone" only.

- Do not file IRS form 1040, but form 1040NR.

- A human being and not a business.

If you are a "taxpayer",

a person engaged in a "![]() trade or business", or

you are domiciled within the "federal

zone", then you should instead consult

http://www.irs.gov for

educational materials. All those who obtain any of the materials off

this website must unconditionally consent to and fully comply with the terms

of our Member Agreement, Form

#01.001 and are forbidden from sending in anything from this website

to the government or legal profession if they do not meet all the requirements

for membership.

trade or business", or

you are domiciled within the "federal

zone", then you should instead consult

http://www.irs.gov for

educational materials. All those who obtain any of the materials off

this website must unconditionally consent to and fully comply with the terms

of our Member Agreement, Form

#01.001 and are forbidden from sending in anything from this website

to the government or legal profession if they do not meet all the requirements

for membership.

12. Your bookstore has a lot of letters listed and they aren't in alphabetical order. How can I find the response letter that's right for me?

There are three ways to locate the responsive letter that addresses the one you received, listed in decreasing order of desirability:

- You can go to our bookstore Search screen and type in the letter number you are looking for. For instance, if you got a "CP504" notice, then type in "CP504" without dashes or spaces. Likewise, if you got a "Letter 1862", then type in "LTR1862" without dashes or spaces. Then hit the "Search" button. You will get a list of all the hits in the database and there usually won't be more than two hits. Click on the hits, examine the letter offered carefully, checkout if its the same one, and you are done.

- You can go to the Index of Federal Notices and Letters and locate the notice you received in the left-hand column. If the letter number is hotlinked, you can click on the hotlink to view a sample Federal notice to make sure you found one like the one you received. Go to the second column on the row you identified under "Get Responsive Letter" and see if there is a response available. If there is, you will see a "Get response" link you can click on to take you directly to the item. Click on this link and then checkout.

- Go directly to the Response Letters screen and browse for the item you want. This is the most time-consuming method.

In all three of the above cases, by the time you finally find the response letter you want in our bookstore, it is always best to closely examine the sample Federal notice or letter that the item responds to in order to ensure that you are getting the right response. The Federal changes their letters often and if the sample we provide does not closely match the notice you received, then chances are that our response letter will not be adequate to address your notice or letter.

NOTE: Members beware! It is your responsibility to ensure that the sample Federal notice or letter we provide matches your letter. If it doesn't, we would appreciate you submitting to us (in high resolution mode) a scanned image of the latest notice you received so that we can write an updated or more appropriate response letter to meet your needs. Submit to us via email as a PDF attachment. Ask us for an email address to send to before doing so via our Contact Us Page. You also might want to submit to us the revised or newer Federal notice so that we can make you a custom or updated response.

13. What if the federal or state notice or letter I received does not have a response available on your website?

No problem! This is what we call a "New Response Letter". There are two types of "New Response Letters": State and Federal. We have two shopping cart items for each of these two options, which are listed below.

When you click on the above two items, you will be taken to the shopping cart items, where you can make a donation and obtain a custom response letter for the precise letter you received. Since we are anxious to develop a library of such letters and responses, then we offer the ability to submit the new letters to get responses without any requirement for donation. In some cases, depending on your need, we also reserve the right to reduce the minimum donation amount. This is a charitable organization and we like to help people in need.

14. Do you have any pointers on how to write a good response letter, in case I want to spruce up what you provide?

Our article entitled "Writing Effective Response Letters, Form #07.002" provides simple, high-level information about this subject. Below are some simple rules that we follow in our own case to ensure best results. Always:

- Provide a copy of the original notice you received to ensure that they know which notice you are responding to.

- Respond promptly and within the time allotted to every letter you receive.

- Indicate that the number they are referring to you with (the SSN

or

TIN) is INCORRECT and line out with a black marker every instance

of it on their letter you attach, and write next to it "incorrect".

Do not provide them a substitute number to use in place of it.

26 U.S.C. §6109 and 26 C.F.R. §301.6109-1 say that TINs may only be

issued to persons domiciled on federal territory and used in connection

with franchises only available to public officers engaged in a "trade

or business" within the U.S. government. "nonresident alien" NON-individuals

not engaged in a public office such as people domiciled in states of

the Union are neither "citizens", "residents", or public officers engaged

in the "trade or business" franchise , then they don't have or need

a TIN. Furthermore, 20 C.F.R. §422.103(d) says the SSN is not "your"

SSN, so it doesn't belong on any form you fill out. It's the government's

number, not "yours".

Click here for more

details.

Click here for more

details. - Be factual and unemotional. Don't argue, but simply reference the facts. Refer to the "code" (not "law", but "code", because there IS no federal income tax "law") and regulations governing your interaction and ask that your conclusions based on them be rebutted if they are inaccurate. If you want to know more about why there is no income tax "law", read Great IRS Hoax, Form #11.302, sections 5.4.1 thru 5.4.1.5

- Don't ASSUME anything! Put the burden of proof on them. "Taxpayers" have the burden of proving that they are NOT liable, but you aren't a "taxpayer" so the burden of proof shifts to them and they must respect your due process rights under the law. Because your response emphasizes that you don't live in the federal zone, you have rights and your letter should emphasize this and demand that they be respected.

- Specify a time limit to respond in which facts stated in your response must be rebutted. Specifically state that all facts unrebutted shall stand as truth in all future proceedings, and follow-up with a Notice of Default listing all the facts that are established by their failure to address the issues presented.

- Sign your letter under penalty of perjury, thus making it into an affidavit that is admissible as evidence in court. Ensure that the perjury statement includes a statement that it is admissible only in a jury trial.

- Include a bill with each response letter, indicating the number of hours required to respond to their frivolous notices, the cost per hour, and the total cost to date. Charge them at a very high hourly rate and insist that they compensate you for your time unless and until they address your issues. Otherwise, they are effecting slavery in violation of the Thirteenth Amendment.

For additional helpful tips and resources on how to write good response letters, refer to our Tax Fraud Prevention Manual, Form #06.008, Chapter 3.

15. Do you have any response letters that address business tax notices or letters?

The only type of response letters we have are targeted towards natural persons, not businesses, trusts, or any other type of artificial entity. We only deal with personal income taxes collected under the authority of Subtitle A of the Internal Revenue Code by those who are "nontaxpayers" and "nonresident aliens".

16. Do your response letters have Bible quotes or religious commentary in them?

The audience of people in state and federal

taxing agencies who would read our response letters are typically poorly

educated atheists. We therefore try very hard to ensure that we stick

strictly to the facts and the law in our response letters and avoid scripture

quotes or religious commentary as much as we can. This is the only

way that the response letters have a chance of being read and acted upon.

We also want to ensure the broadest possible audience for our response letters

within the bounds of our

![]() Member Agreement, Form #01.001,

so we try to accommodate for the fact that our readers may believe in God,

but that they may not have a Christian God. Therefore, we avoid references

specifically to the Bible, because some of our readers may have other sources

of scripture.

Member Agreement, Form #01.001,

so we try to accommodate for the fact that our readers may believe in God,

but that they may not have a Christian God. Therefore, we avoid references

specifically to the Bible, because some of our readers may have other sources

of scripture.

17. Are your response letters copyrighted or copy protected?

All of our response letters come in electronic form and are copyrighted and copy protected. The only thing that can be edited is the worksheet where you fill in your personal information. Everything else may not be copied or pasted using the Windows clipboard and may only be viewed. If you discover errors in any of our response letters, please send us an errata list via email and we will be happy to correct the errors and send you back an amended letter within a couple days. An errata list is a detailed, itemized list of all of the factual, grammar, spelling, and typing errors you found in the letter, exactly what line number, paragraph, and page number they appear at, along with exactly what you suggest as a correction. Otherwise, we are not authorized to compromise the copyright or give you an unlock password to enable you to edit the response letter in its entirety. We are also not able to let people preview our letters BEFORE they make a donation to obtain them.

There are other important reasons that we copy protect the letters. We want to ensure that:

- When our users find something wrong with our letter, they immediately point it any errors observed out to us and have us fix it for them, instead of them fixing it themselves.

- Erroneous positions and conclusions are not added to the letters.

This way, we can continually improve our letters through feedback and also ensure that they are not misused. We want to keep our members from adding patriot mythology or bad positions to our letters that will harm or prejudice not only them, but our credibility as well.

If you are in a bind and must make immediate changes to the letter without access to edit it, only two ways are available to deal with this situation:

- Scan in the printed letter and do character recognition on it using Nuance Omnipage.

- Retype the letter from within Microsoft Word.

One last point: Please do not call us to ask if we can make an exception to our copyright policy and give you an editable version of our letters. We make no exceptions for anyone and you will be wasting your time.

Lastly, if you would like to know how the letters are used and customized, please see the following, which contains a video demonstrating how the customization process works:

18. If I already did the "New Response Letter" process once, do I still need to do the whole thing again if I have another letter that needs a new response?

The answer is YES. If you just submit to us the notice you receive without any explanation, then we have no way of knowing what you want us to do with it. If you want a new response letter, you need to be very explicit and follow one of the following two procedures for New Response Letters below:

19. Can I "preview" the letter I want before I donate to get it?

The answer is NO. We are well aware that some people may be reluctant to obtain our letters and would prefer to look at them to see if they are worth the minimum donation amount BEFORE they get them. However, we are not able to accommodate such a request because:

- It violates the copyright as indicated earlier in question 16 above.

- It encourages people to plagiarize our work without contributing anything to either improve it or sustain it, and we can't permit this because it amounts to the equivalent of theft of our time and resources.

If you believe the minimum donation amount is not worth it to you, then you are encouraged to write your own response letters and there are plenty of resources available on this website and the Family Guardian to help you with that process. You will be hard pressed, however, to duplicate the level of research and experience that goes into our response letters.

20. Why does the response letter I got ask me for a "Project Password" and why don't the "Print" and "Preview" pushbuttons work in the letter?

You aren't reading and following the "Response Letter Instructions" at the beginning of the letter. Those instructions tell you to set your Microsoft Word macro security level to "Low" BEFORE you print or preview the letter. Failure to do this will cause a macro error in the code when you push the "Preview" or "Print" pushbuttons at the end of the Response Letter Worksheet. Since the code is protected with a password and is locked from viewing, then you can't see the error but now you know its cause. Please follow the directions. For a video demonstration of how to set Microsoft Word Macro Security to the low state see section 3.3 below:

SEDM Support, Section 3.3

21. Do you have a list of common false arguments that I should avoid putting in my response letters so I stay out of trouble?

The most useful reference we know of on this subject is available for free at the link below:

22. Is there anything criminal or illegal about using your response letters?

The First Amendment to the Constitution of the United States of America guarantees us a right to Petition our Government for a redress of grievances, which in this case are illegal or unconstitutional enforcement actions against parties who are "nontaxpayers" not subject to the Internal Revenue Code and who have no legal "duty" to pay any monies to either the state or federal governments. Below is a link to an exhaustive legal analysis of our inalienable right to Petition our government for a redress of grievances and illegal or unconstitutional activities:

Statement of Facts and Beliefs Regarding the Right to Petition the Government for a Redress of Grievances (OFFSITE LINK)

Below is what federal courts have said on the subject of making the exercise of a Constitutional right into a crime:

"The claim and exercise of a constitutional right cannot be converted into a crime."

[Miller v. US, 230 F 486, at 489]

"It is an unconstitutional deprivation of due process for the government to penalize a person merely because he has exercised a protected statutory or constitutional right. United States v. Goodwin, 457 U.S. 368, 372 , 102 S.Ct. 2485, 2488, 73 L.Ed.2d 74 (1982)."

[People of Territory of Guam v. Fegurgur, 800 F.2d 1470 (9th Cir. 1986)]"Due process of law is violated when the government vindictively attempts to penalize a person for exercising a protected statutory or constitutional right."

[United States v. Conkins, 9 F.3d. 1377, 1382 (9th Cir. 1993)]

Furthermore, the First Amendment also guarantees us a right to assemble, and especially in the preparation of such Petitions. That means that you have a protected Constitutional right to request education or help in preparing such a Petition. That very situation, in fact, is the reason for existence of this ministry. Even if the Petition is wrong, it still cannot be a crime to Petition. To suggest otherwise is to suggest that:

- The authority of law can be used to interfere with its own enforcement. This is an absurdity.

- Anyone can be thrown in jail at any time just for having wrong opinions or an inadequate education, which clearly would violate the First Amendment. The Federal Rules of Civil Procedure, Rule 11(c)(2)(A), in fact, prohibit judges from sanctioning parties who have made a frivolous legal argument, because this would constitute an interference with political activity which is beyond the reach of any court.

- The Courts have the authority to interfere with "political activity"

and political speech. This is a violation of the

Separation of Powers

Doctrine, which says that Courts of justice may not lawfully involve

themselves in "political questions".

Separation of Powers

Doctrine, which says that Courts of justice may not lawfully involve

themselves in "political questions".

Click here for

an article on "Political Jurisdiction" that thoroughly examines this

corruption of our de jure government.

Click here for

an article on "Political Jurisdiction" that thoroughly examines this

corruption of our de jure government. - We have no separation of powers (OFFSITE LINK) and judges are part of the Legislative Branch, not the Judicial Branch. Click here (OFFSITE LINK) for an article on the separation of powers doctrine.

Here is what the U.S. Supreme

Court said on this subject about the government's authority to interfere

with free, non-commercial speech.

![]() Click here for an additional article on "commercial

speech":

Click here for an additional article on "commercial

speech":

"This court has not yet fixed the standard by which to determine when a danger shall be deemed clear; how remote the danger may be and yet be deemed present; and what degree of evil shall be deemed sufficiently substantial to justify resort to abridgment of free speech and assembly as the means of protection. To reach sound conclusions on these matters, we must bear in mind why a state is, ordinarily, denied the power to prohibit dissemination of social, economic and political doctrine which a vast majority of its citizens believes to be false and fraught with evil consequence. [274 U.S. 357, 375] Those who won our independence believed that the final end of the state was to make men free to develop their faculties, and that in its government the deliberative forces should prevail over the arbitrary. They valued liberty both as an end and as a means. They believed liberty to the secret of happiness and courage to be the secret of liberty. They believed that freedom to think as you will and to speak [and educate] as you think are means indispensable to the discovery and spread of political truth; that without free speech and assembly discussion would be futile; that with them, discussion affords ordinarily adequate protection against the dissemination of noxious doctrine; that the greatest menace to freedom is an inert people; that public discussion [and education] is a political duty; and that this should be a fundamental principle of the American government. 3 They recognized the risks to which all human institutions are subject. But they knew that order cannot be secured merely through fear of punishment for its infraction; that it is hazardous to discourage thought, hope and imagination; that fear breeds repression; that repression breeds hate; that hate menaces stable government; that the path of safety lies in the opportunity to discuss [and educate other people about] freely supposed grievances and proposed remedies; and that the fitting remedy for evil counsels is good ones. Believing in the power of reason as applied through public discussion, they eschewed silence [274 U.S. 357, 376] coerced by law [or the IRS]-the argument of force in its worst form. Recognizing the occasional tyrannies of governing majorities, they amended the Constitution so that free speech and assembly should be guaranteed.”

[Whitney v. California, 274 U.S. 357 (1927)]

Another purpose of our response letters is to point out violations of the law and the Constitution by public servants, and the deception, unequal protection (hypocrisy), and tyranny that facilitates them. On this subject, the Supreme Court has ruled the following, in support of this goal. [NOTE: We don't agree that America is a democracy as the Supreme Court indicates below, but we agree that a free press is important. It INSTEAD is a REPUBLIC. See section 4.5 of this link for the reasons why.]

"In the First Amendment, the Founding Fathers gave the free press the protection it must have to fulfill its essential role in our democracy. The press [and this religious ministry] was to serve the governed, not the governors. The Government's power to censor the press was abolished so that the press would remain forever free to censure the Government. The press was protected so that it could bare the secrets of government and inform the people. Only a free and unrestrained press can effectively expose deception in government. And paramount among the responsibilities of a free press is the duty to prevent any part of the government from deceiving the people and sending them off to distant lands to die of foreign fevers and foreign shot and shell. In my view, far from deserving condemnation for their courageous reporting, the New York Times, the Washington Post, and other newspapers should be commended for serving the purpose that the Founding Fathers saw so clearly. In revealing the workings of government that led to the Vietnam war, the newspapers nobly did precisely that which the Founders hoped and trusted they would do."

[New York Times Co. v. United States, 403 U.S. 713 (1970)]

The First Continental Congress was even more bold in approaching this situation. Below is what they said on this subject, when they were protesting the imposition of taxation without representation by the British in the original colonies:

“If money is wanted by Rulers who have in any manner oppressed the people, they may retain it until their grievances are redressed, and thus peaceably procure relief, without trusting to despised petitions or disturbing the public tranquility.”

[Continental Congress, 1774; Am. Pol., 233; Journals of the Continental Congress, October 26, 1774]

In addition to the above, a major goal of our response letters is to prevent and prosecute unlawful activities by others, such as those submitting false information returns. Any attempt by federal employees and officers to interfere with creating or sending our response letters therefore constitutes obstructing justice, in criminal violation of 18 U.S.C. §§1505 and 1510.

23. The example notice posted on your site is much older than the revision date on the notice I received. Can I still use the response letter you provide?

The sample Federal notice on our site is the version that we have an answer for. If the notice you received have doesn't match the example posted and the issues raised in the notice are significantly different, then it may be best to submit the new notice you received for a revised response. If you choose to do so, please follow the:

- "New Federal Response Letter" procedure documented at: http://sedm.org/SampleLetters/Federal/FedLetterAndNoticeIndex.htm

- "New State Response Letter" procedure documented at: http://sedm.org/SampleLetters/States/StateRespLtrIndex.htm

24. Why do I have to write the certified mail number on the letter rather than just typing it into the letter worksheet and printing it?

Most people do not have Certified mail cards lying around there house with pre-assigned serial numbers. Usually, they go to the post office to mail the Certified Letter and get the card and the serial number there. By that point, they have already printed the letter so they have to write the Certified Mail # on the letter by hand. These are the crowd we cater to. If you happen to pick up a bunch of the cards and take them home, then you are the exception. We are sorry, but you are just going to have to write the numbers onto the letter by hand in your case so that the lowest common denominator can be accounted for.

25. Is a "package deal" available for all the response letters in one group?

No. You must obtain each response letter when or as it is required. Any other approach would encourage people to give away response letters to friends and relatives for free, and would encourage violation of copyright on the letters. Sorry

26. I want to use my response letter for a husband and wife. How can I enter the names in the response letter worksheet?

Usually, Federal letters to couples are made out to "John and Jane Smith" or the like. To write a response letter for a couple, fill in "John and Jane" in the Firstname field of the worksheet, leave the middle name blank, and then enter their common last name in the Lastname field of the worksheet.

27. Can I pay you to customize a response letter obtained through your bookstore to my particular circumstances?

Question: Can I pay you to customize a response letter obtained through your bookstore to my particular circumstances?

Answer: Our response letters are prepared for GENERAL use by those who full satisfy our member agreement. We have no interest, even in exchange for a donation, in customizing response letters available through our Ministry Bookstore to particularize them to your specific and personal and individual circumstances. Please do not ask us to do it.

On the other hand, we always encourage those who obtain our response letters to suggest improvements to them. That is how we make them better. Your suggestions are appreciated and will be welcomed, provided that you are able to defend and justify with legal evidence why you think they need to be changed. Our Member Agreement, in fact, goes so far as to say that it is the duty of ALL members to immediately bring inaccuracies in our materials to our attention immediately when discovered. You can submit your suggestions for changes or improvements to:

Contact Us Page

28. I'm in desperate financial shape and I am not able to make a donation to the ministry. Can you send me a free response letter?

The answer is that you may qualify for a free letter. We commonly do this for those who have demonstrated, genuine need. This is a ministry and not a business and we are happy to help those who cannot always help themselves. For details on whether you qualify, please see our Frequently Asked Questions, Question #1.8.

29. Should I send only the response letter by itself or can I use it in addition to other documents, like a DEMAND FOR VERIFIED EVIDENCE OF LAWFUL FEDERAL ASSESSMENT? What I'm asking is, does this affect the effectiveness of one or the other?

We can't tell you what to do in your case or give advice. However, we very commonly attach other forms to our responses such as the Demand for Verified Evidence of Lawful Federal Assessment, Form #07.304 and do not obsess about adversely affecting the effectiveness of our personal response. The important thing is, we try to make our response as short and succinct as we can so that it will get read, will be understood, and hopefully will be acted upon in our favor.

30. When I try to type in the response letter worksheet, Microsoft Word says that the document is locked. What am I doing wrong?

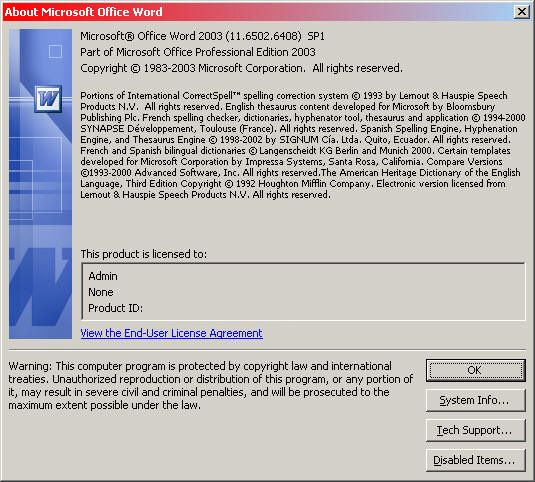

Most likely, you are using an older version of Microsoft Word or you have not done all the latest update on MS Word. To find out:

- Start Microsoft Word.

- Select "Tools->About" from the menus at the top of the Microsoft Word window. A dialog box will pop up.

- Look at the top of the dialog box for the version of MS Word you

have installed. It should say something like "Microsoft Word 2003

(11.6502.6408) SP1". If the "SP1" is missing, then you haven't

installed the latest patches to Microsoft Word and you need to update

your entire Microsoft Office to the latest version. The remainder

of the steps below explain how to do that.

- Open your Internet Explorer.

- Type "http://officeupdate.com" in the address bar and hit return.

- Click on the "Check for Updates" at the top.

- Follow the directions on the Microsoft Website for updating all your Microsoft office applications with the latest patches.

- Restart your computer.

- Open your Internet Explorer.

- Select "Tools->Windows Update" from the Internet Explorer menus at the top of the Internet Explorer window.

- Check for the latest updates to MS Windows.

- Install all updates that are recommended. This may take several iterations to complete if you are far behind.

- Reboot your computer.

- You are done.

31. Are there any types of tax notices that you can't write a response for? Why won't you make a response for my letter?

Generally,

we can't prepare responses for any type of letter that asks for corrections

to a return or amended return that you filed. This is a requirement

of the

![]() SEDM Articles of Mission, Form

#01.004, Section 2.5, Item 6, which lists Prohibited Activities that

we may not engage in. We cannot help "taxpayers",

prepare returns, or assist or advise in the preparation of tax returns.

This limitation is intended to prevent us from ever being accused of offering

"tax

shelters" or engaging in "commercial"

activities prohibited under

26 U.S.C. §6700,

6701, or

7402, or

7408. This also prevents us from waiving sovereign immunity under

the

Foreign Sovereign Immunities Act, 28 U.S.C. §1602 et seq, by "purposefully

availing" ourselves of commercial benefits of the federal zone or federal

forum. See

SEDM Articles of Mission, Form

#01.004, Section 2.5, Item 6, which lists Prohibited Activities that

we may not engage in. We cannot help "taxpayers",

prepare returns, or assist or advise in the preparation of tax returns.

This limitation is intended to prevent us from ever being accused of offering

"tax

shelters" or engaging in "commercial"

activities prohibited under

26 U.S.C. §6700,

6701, or

7402, or

7408. This also prevents us from waiving sovereign immunity under

the

Foreign Sovereign Immunities Act, 28 U.S.C. §1602 et seq, by "purposefully

availing" ourselves of commercial benefits of the federal zone or federal

forum. See

![]() Yahoo Inc. v. La Ligue Contre Le Racisme Et L'Antisemitisme, 433 F.3d. 1199

(2006). Receipt of a notice that relates to a return or amended

return that you filed indicates that you have made yourself a "taxpayer"

by making an "election" (choice) to have your income treated as taxable

as a "U.S.

person" defined in

26 U.S.C. §7701(a)(30). The option of making an "election" as a "nonresident

alien" to be treated as a "resident alien" who is a "taxpayer"

is found in regulation

26 U.S.C. §6013(g),

26 U.S.C. §7701(b)(4), and

26 C.F.R. §1.871-1(a). Any time one makes such an election for the year

in question, that individual is [at least for that year] identified as a

"taxpayer" of the

I.R.C. Subtitle A federal income tax.

Yahoo Inc. v. La Ligue Contre Le Racisme Et L'Antisemitisme, 433 F.3d. 1199

(2006). Receipt of a notice that relates to a return or amended

return that you filed indicates that you have made yourself a "taxpayer"

by making an "election" (choice) to have your income treated as taxable

as a "U.S.

person" defined in

26 U.S.C. §7701(a)(30). The option of making an "election" as a "nonresident

alien" to be treated as a "resident alien" who is a "taxpayer"

is found in regulation

26 U.S.C. §6013(g),

26 U.S.C. §7701(b)(4), and

26 C.F.R. §1.871-1(a). Any time one makes such an election for the year

in question, that individual is [at least for that year] identified as a

"taxpayer" of the

I.R.C. Subtitle A federal income tax.

For your information: "taxpayers" are those in the following categories as indicated in the IRC "special laws".

- Federal Workers [federal officers, federal employees, elected officials of the United States -the federal government].

- Statutory but not constitutional "U.S. citizens" defined at 8 U.S.C. §1401(a) as federal statutory creations of Congress.

- Statutory "Residents" defined in 26 U.S.C. §7701(b)(1)(A), who are aliens domiciled on federal territory within the "United States".

- Those who operate in a representative capacity in behalf of the

federal government by using an SSN which is federal property per

20 C.F.R. §422.103(d).

Click here

for an article on this important subject.

Click here

for an article on this important subject.

As such each of those who are "taxpayers" are stated to be ones who derive their income from being engaged in the conduct of a "trade or business" [performance of the functions of a public office per 26 U.S.C. §7701(a)(26)] in the United States [defined to mean only the District of Criminals ...oops Columbia, per 26 U.S.C. §§7701(a)(39) and 26 U.S.C. §7408(d)].

Any individual can 'elect' to make their income treated as taxable by filing a federal income tax return even when Mr. Michael L. White, Federal Attorney in the Office of the Federal Register has stated in his 1994 legal opinion letter that "Our records indicate that the IRS has not incorporated by reference in the Federal Register a requirement to make an income tax return."

There is nothing SEDM can do for those who receive notices that can only be received by "taxpayers", such as the LTR0418C, LTR3176C, and LTR3572, all of which relate to filing or re-filing or amending returns. SEDM only assists those who are lawful "nontaxpayers" and we will never interfere with the obligations of those who are identified as "taxpayers". According to our Member Agreement, Form #01.001, SEDM can only help you for the years in which you did not make an election and are not any one of the 4 basic kinds of "taxpayers" indicated above.

If you

did not in fact file a return or amended return for a particular year and

you find yourself receiving one of the notices

LTR0418C,

LTR3176C, and

LTR3572, then most likely,

the authorities did an Automated Substitute for Return (ASFR) for the tax

year in question using information derived from false Information Returns

(such as W-2, 1098, 1099, etc) which were filed against the TIN you have

been using by an IGNORANT employer or financial institution who refuses

to read or comply with the law. These SFR's are ILLEGAL and the IRS

agent who did them can be prosecuted if you wish to take the time for that.

This is covered in

![]() our memorandum of law on

SFRs. You can find out about these SFRs by doing a Freedom of

Information Act (FOIA) request for them, using our

Master File Decoder.

If we were faced with such as situation in our own case, we would:

our memorandum of law on

SFRs. You can find out about these SFRs by doing a Freedom of

Information Act (FOIA) request for them, using our

Master File Decoder.

If we were faced with such as situation in our own case, we would:

- Fill out the Demand for Verified Evidence of Lawful Assessment.

There are two types of forms:

1.1 Demand for Verified Evidence of Lawful Assessment: Federal, Form #07.304

1.2 Demand for Verified Evidence of Lawful Assessment: State, Form #07.204

- Fill out corrected information returns for the years covered by the notice and attach them to the Demand for Verified Evidence of Lawful Assessment. Click here and look at section 4.2 for information on how to complete corrected information returns.

- We would attach to the demand a cover letter indicating that we never filed a return, and that it is likely that an illegal Substitute For Return was done which must be abated. Click here for the Memorandum of Law that covers the illegality of Substitute for Returns using IRS Form 1040.

- The letter and the Demand for Verified Evidence of Lawful Assessment would be mailed to at least two addresses: revenue service center and the commissioner or one of his attorney friends. Click here for addresses to send.

- After sending the letter, we would wait a week or two and do a follow-up to make sure they fix their mistake.

Another alternative to completing the above process is to file a Substitute for Return from the list below, and include all the necessary attachments and a cover letter. The link below shows how to do this:

- Response to request for tax return (OFFSITE LINK)

32. I can't open or view my response letter in my word processor. What am I doing wrong?

As we state repeatedly throughout this document, in our Support Page, Section 3, and in the description of each response letter in our Bookstore, all of our response letters require Microsoft Word version 2000 or later be installed before you can view, edit, or print any of our response letters. Chances are, you are a computer novice who does not have Microsoft Word installed and instead has another word processor, like Microsoft Works or Word Perfect. You probably bought your computer recently and only have the standard free software installed, which is usually Microsoft Works. If you try to open the response letter in these non-approved applications such as these two and many others, you will definitely get errors, the letter won't open or print properly, and the macros and worksheets won't function. If you want to be able to use your response letter at that point, the following options are available to you:

- You can go out and invest some money to get the Microsoft Word program. This will cost you about $150 if you buy it separate.

- You can buy

Microsoft Office Standard or Professional, which also have this

program included. This will cost you about $300 and it is available

at any office supply or computer store or on the Internet. If you also

intend to eventually do

IMF Decoding, you should get

Microsoft Office Professional, because it also includes the

Microsoft Access database that you will need in order to run our

Master File Decoder program.

IMF Decoding, you should get

Microsoft Office Professional, because it also includes the

Microsoft Access database that you will need in order to run our

Master File Decoder program. - You can find a friend or family member who has this program installed and create your response letter on their computer.

- You can go to a public library and use the computers there, which is usually free. Many of these computers frequently have Microsoft Word installed on them, but most will usually only be used for web browsing and Internet and may not work.

Which of the above options you choose to solve your problem is up to you. The best option in most cases, we think, is option #2 above, but it is the most expensive, unfortunately. Whatever the case, you should make sure you save your response letter on your local hard drive before the 48 hour maximum download interval expires so that you don't have to contact us again later to send it to you AFTER you solve your problem by one of the above methods. Good luck!

33. I ordered one of your letters as a "taxpayer" and now realize that they are only intended for "nontaxpayers" who meet all the requirements for being a Member. Should I use the letter and what should I do?

You can't

obtain anything from our Ministry Bookstore

without being a Member,

and this requirement is presented in BIG

RED LETTERS at least three times in a row during the bookstore

checkout procedure. Our

Member Agreement, Form #01.001

has strict requirements that you be a "nontaxpayer"

with no tax liability for any years that you intend to employ any of the

materials available on this website and that if you did file a tax return,

that it indicated no "gross

income" (OFFSITE LINK) and no liability, and that it is either an

![]() AMENDED IRS form 1040NR or our

AMENDED IRS form 1040NR or our

![]() Federal Nonresident

Nonstatutory Claim for Return of Funds Unlawfully Paid to the Government-Long,

Form #15.001.

Federal Nonresident

Nonstatutory Claim for Return of Funds Unlawfully Paid to the Government-Long,

Form #15.001.

THERE ARE NOT EXCEPTIONS TO THIS POLICY!

All of

our response letters and other bookstore materials are built around the

premise that the person using them complies

fully with the

Member Agreement, Form #01.001

and they are neither intended nor recommended for use by those who don't.

You indicated that you filed 1040 returns for the years in question and

voluntarily assessed yourself a liability, and thereby made yourself

a "taxpayer"

for those particular years in question. We can't recommend use of

our materials in such a case or help in their use for "taxpayers"

and doing so violates our

![]() Articles of Mission, Form #01.004

and our Member Agreement, Form

#01.001. We very deliberately and consistently tell all "taxpayers"

to quit bitching or complaining, to shut up, and to pay whatever they

voluntarily assessed themselves, and be "good slaves" and "government

whores". This is made clear in our

Frequently Asked Questions, Question

#1.1, which you ought to read and abide by. We remind our readers

that a tax voluntarily paid is NONREFUNDABLE:

Articles of Mission, Form #01.004

and our Member Agreement, Form

#01.001. We very deliberately and consistently tell all "taxpayers"

to quit bitching or complaining, to shut up, and to pay whatever they

voluntarily assessed themselves, and be "good slaves" and "government

whores". This is made clear in our

Frequently Asked Questions, Question

#1.1, which you ought to read and abide by. We remind our readers

that a tax voluntarily paid is NONREFUNDABLE:

The principle that taxes voluntarily paid can not be recovered back is thoroughly established. It has been so declared in the following cases in the Supreme Court: United States v. New York & Cuba Mail Steamship Co. (200 U. S. 488, 493, 494); Chesebrough v. United States (192 U. S. 253); Little v. Bowers (134 U. S. 547, 554); Wright v. Blakeslee (101 U. S. 174, 178); Railroad Co. v. Commissioner (98 U. S. 541, 543); Lamborn v. County Commissioners (97 U. S. 181); Elliott v. Swartwout (10 Pet. 137). And there are numerous like cases in other Federal corn: Procter & Gamble Co. v. United States (281 Fed. 1014); Vaughan v. Riordan (280 Fed. 742, 745); Beer v. Moffatt (192 Fed. 984, affirmed 209 Fed. 779); Newhall v. Jordan (160 Fed. 661); Christie Street Commission Co. v. United States (126 Fed. 991); Kentucky Bank v. Stone (88 Fed. 383); Corkie v. Maxwell (7 Fed. Cas. 3231).

And the rule of the Federal courts is not at all peculiar to them. It is the settled general rule of the State courts as well that no matter what may be the ground of the objection to the tax or assessment if it has been paid voluntarily and without compulsion it can not be recovered back in an action at law, unless there is some constitutional or statutory provision which gives to one so paying such a right notwithstanding the payment was made without compulsion.--Adams v. New Bedford (155 Mass. 317); McCue v. Monroe County (162 N.Y. 235); Taylor v. Philadelphia Board of Health (31 P. St. 73); Williams v. Merritt (152 Mich. 621); Gould v. Hennepin County (76 Minn. 379); Martin v. Kearney County (62 Minn. 538); Gar v. Hurd (92 Ills. 315); Slimmer v. Chickasaw County (140 Iowa, 448); Warren v. San Francisco (150 Calif. 167); State v. Chicago & C. R. Co. (165 No. 597).

There are many good reasons for our strict policy not to assist or condone the often injurious and reckless activities of those who do not comply with our Member Agreement, Form #01.001. The main reasons are to avoid and prevent:

- Illegal, criminal, or injurious behavior on your part in jusing our materials or services.

- Knowingly discrediting and injuring the person who is misusing or misapplying the law and our materials.

- People who are misusing our materials from being criminally prosecuted for interfering with the lawful administration of the I.R.C. against its proper subject, "taxpayers" pursuant to 26 U.S.C. §7212.

- Knowingly discrediting ourself by associating our materials with

flawed tax arguments.

flawed tax arguments.

- Violating our Disclaimer, which has very strict rules on how and by whom our materials may be used.

- Violating our Member Agreement, Form #01.001, section 5, which describes all of the abuses of our materials that are strictly prohibited.

- Violating the

SEDM Articles of Mission,

Form #01.004.

SEDM Articles of Mission,

Form #01.004. - Needlessly clogging the IRS with inappropriate correspondence that is irrelevant to the person using it and needlessly wastes their time and limited resources.

- Being prosecuted for unlawfully engaging in "tax shelters" in violation of 26 U.S.C. §6700. We remind our readers that our Disclaimer says that those who are using our materials for any financial or commercial purpose are misusing them.

Remember,

we are a religious ministry and everything we do MUST be beyond reproach

and not injurious to ANYONE, including the government, and may not have

any ![]() commercial purpose whatsoever. No matter how much we may dislike

the wicked and unlawful things that our public dis-servants do so frequently

to people like you under the "color of law", two wrongs

don't make a right.

We seek to honor the Lord and

all men, including those in government who have done nothing

to earn or even deserve any kind of honor.

commercial purpose whatsoever. No matter how much we may dislike

the wicked and unlawful things that our public dis-servants do so frequently

to people like you under the "color of law", two wrongs

don't make a right.

We seek to honor the Lord and

all men, including those in government who have done nothing

to earn or even deserve any kind of honor.

"Therefore submit yourselves to every ordinance of man [WHICH ONLY IS] for the Lord’s sake, whether to the king as supreme, or to governors, as to those who are sent by him for the punishment of evildoers and for the praise of those who do good. For this is the will of God, that by doing good you may put to silence the ignorance of foolish [government] men— as free, yet not using liberty as a cloak for vice, but as bondservants [fiduciaries, where the Bible is the "bond"] of God. Honor all people. Love the brotherhood. Fear God. Honor the king."

[1 Peter 2:13-17, Bible, NKJV]

Therefore, NO we absolutely won't help you adapt the letter you obtained from our Ministry Bookstore to your circumstance as a "taxpayer", and if you want to do it yourself, that is your choice and entirely and exclusively your responsibility. We caution you that you are heading for trouble by acting like a "taxpayer" with an admitted voluntary liability and yet claiming you are a "nontaxpayer" in your correspondence with the IRS. Do your homework FIRST and carefully withdraw from the system so that you meet all the requirements for membership and THEN, and ONLY THEN may you use or apply our materials and only for those years where you meet ALL of the requirements for membership. A summary of that procedure is contained in section 1 of the following:

Federal and State Tax Withholding Options for Private Employers, Form #09.001

Don't

run off half-cocked without doing

all your homework

FIRST or you are going to end up as cannon fodder of tyrants. Patiently

give yourself time to study and unlearn all the

LIES and half-truths and propaganda that your government and legal profession

oppressors have been feeding you all these years, and then to relearn

the TRUTH (OFFSITE LINK) by reading the law for yourself so that you

convincingly understand and can explain exactly what you are doing

before you make any

important or life-changing decisions. We studied the law on this matter

for several years before we made our first decisive move to leave the system.

It was done very carefully and very deliberately and very properly, because

we knew that the IRS' favorite targets for persecution and "selective enforcement"

are those who are just getting started and who don't have a full war chest

of knowledge or information tools to fight them with. Turn off the

TV, quit watching sports and sitcoms, and invest in your own education by

diligently and consistently studying

![]() God's Law and

man's law on this website, and

they are much more likely to leave you alone and respect your sovereignty.

God's Law and

man's law on this website, and

they are much more likely to leave you alone and respect your sovereignty.

“I will set nothing wicked before my eyes [sex, violence, vanity on TV]; I hate the work of those who fall away; it shall not cling to me. A perverse heart shall depart from me; I will not know wickedness.”

[Psalm 101:3-4, Bible, NKJV]

“Turn away my eyes from looking at worthless things [TV], and revive me in Your way. Establish Your word in Your servant, who is devoted to fearing You.”

[Psalm 119:37-38, Bible, NKJV]

Unfortunately, all donations to the ministry are final so we can't refund your generous gift for the letter. Caveat emptor. Sorry.

34. Can I use a word processor other than Microsoft Word to prepare the response letter?

Question: I use Open Office or Libre Office on my machine, because I can't afford Microsoft Word. Will that work? What about other word processors?